Tom Barker, Assistant Superintendent – Elementary Schools Cortney Gnatt, Assistant Superintendent – Elementary Schools Marcy Hetzler-Nettles, Assistant Superintendent – Middle Schools Vanessa Hilton, Chief Academic Officer

Dr. Monica Ilse, Assistant Superintendent – High Schools Kimberly Poe, Assistant Superintendent – Elementary Schools James Greene, General Counsel to the Superintendent

Elizabeth Kuhn, Assistant Superintendent for Support Services Kevin Shibley, Assistant Superintendent for Administration

Melanie Waxler, Director of Strategic Communications

THIS PAGE INTENTIONALLY LEFT BLANK.

TABLE OF CONTENTS

SECTION I INTRODUCTION

TRANSMITTAL LETTER 1-21

ADVERTISEMENT - BUDGET SUMMARY 22

ADVERTISEMENT - NOTICE OF PROPOSED TAX INCREASE 23

ADVERTISEMENT - CAPITAL OUTLAY 24

HISTORY OF SCHOOL MILLAGES 25

GENERAL OPERATING FUND-REVENUES AS A PERCENTAGE OF

TOTAL OPERATING BUDGET 26

ANALYSIS OF APPROPRIATIONS FOR GENERAL OPERATING BUDGET 27-29

SECTION II BUDGET SUMMARY

GENERAL FUND 30

DEBT SERVICE FUND 31

CAPITAL PROJET FUNDS 32-35

SPECIAL REVENUE FUNDS 36

INTERNAL SERVICE FUNDS 37

TRUST & AGENCY FUNDS 38

ENTERPRISE FUNDS 39

SECTION III FINANCIAL AND STAFF ALLOCATIONS

GLOSSARY 40

ELEMENTARY SCHOOLS 41-47

MIDDLE SCHOOLS 48-50

HIGH SCHOOLS 51-53

COMBINATION SCHOOLS 54

EDUCATION CENTERS 55-56

CHARTER SCHOOLS 57-58

DISTRICT 59-65

STAFF ALLOCATIONS 66-79

To provide a world-class education for all students.

Vision

All our students achieve success in college, career and life.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

Dear Honorable School Board Members:

The proposed budget of the District School Board of Pasco County for fiscal year 2023-2024 is submitted herewith. This budget has been developed based on the mission and goals of the School Board. The budget includes all Governmental and Proprietary Funds of the District and the proposed tax rate for the 2023 calendar year.

Florida Law requires the School Board to adopt a balanced budget each fiscal year for all funds under its authority: General Fund, Debt Service Funds, Capital Outlay Funds, Special Revenue Funds and Trust & Agency Funds.

The law is specific in defining the process and timetable to be followed in adopting the budget and ad valorem property tax millage rates. By law, the School Board must conduct two public hearings on the proposed budget and millage rates.

CERTIFICATION OF ASSESSED VALUE OF TAXABLE PROPERTY

The County Property Appraiser is required by law to certify to each taxing authority in the County the assessed value of all non-exempt taxable real property. The Property Appraiser, who is independent of the School Board, is required to provide this certification no later than July 1 each year.

Based on the 2023 tax roll provided by the Department of Revenue and certified by the Commissioner of Education on July 19, 2023, the following is a summary of proposed millages to be levied on the 2023 tax roll for the 2023-2024 fiscal year:

Proposed | Final | Increase/ | |||

2023-2024 | 2022-2023 | (Decrease) | |||

State Required Local Effort | 3.201 | 3.268 | (0.067) | ||

Prior Period Adjustment | 0.000 | 0.000 | 0.000 | ||

Local: | |||||

Discretionary Effort | 0.748 | 0.748 | 0.000 | ||

Voted Additional Levy* | 1.000 | 0.000 | 1.000 | ||

Local Capital Improvement Millage | 1.500 | 1.500 | 0.000 | ||

Total Millage Levy | 6.449 | 5.516 | 0.933 |

* The Board had the authority to levy up to an additional 1 mill

The taxable value of property in Pasco County has experienced an increase this year. The tax base increased $8.2 billion to a total of $54.8 billion this fiscal year. This reflects an increase of 17.64% in the tax base. The required local effort is set at 3.201 mills. The Local Capital Improvement Millage will remain at 1.500 mills. The remaining 0.748 mills are Discretionary Millage. The 0.748 millage generates an average of $445.01 per unweighted full-time student. A compression adjustment is calculated to equalize the funding to all school districts at the State average level of $795.19. Since the Required Local Effort is set by the Legislature each year, the District School Board has limited flexibility in determining the millage. Additionally, the State bases the District’s funding on the assumption that it will levy the full 0.748 Discretionary mills. If the District fails to levy the full discretionary amount, it will lose $31.0 million in compression adjustment revenue from the State.

In August of 2022, the voters of Pasco County approved a 4-year millage referendum authorizing the Board to levy up to an additional 1 mil in each of the four years covered by the referendum, to improve the salaries of the District’s non- administrative employees. For the 2023-2024 school year, approximately $52,672,826 of referendum revenue will be generated based on a 1 mil levy of the projected 2023 Pasco County tax roll. Assuming a maximum collection rate of 96%, establishing a 5% reserve for fund balance, and providing eligible charter schools with their proportional share of funds, the District estimates $43,880,000 will be available to provide non-recurring salary supplements including, mandatory employer withholdings, for the District’s non-administrative employees. Providing a proportional share of funds to each of the eligible employee groups, an estimated $28,860,000 will be provided for Instructional employees, $10,410,000 for SRP employees,

$3,730,000 for NNB employees, and $880,000 for Professional-Technical employees.

Under the proposed rate, the owner of a $350,000 home, after deduction of the $25,000 homestead exemption, would pay

$2,095.93, which is an increase of $303.23 from 2022 millage.

School Taxes | School Taxes | |

2023-2024 | 2022-2023 | |

ASSESSED VALUE | $ 350,000 | $ 350,000 |

Less: Homestead Exemption | (25,000) | (25,000) |

Taxable Value | $ 325,000 | $ 325,000 |

MILLAGE | Amount | Amount |

Required Local Effort* | $ 1,040.33 | $ 1,062.10 |

Voted Additional Levy | 325.00 | - |

Discretionary Effort* | 243.10 | 243.10 |

Capital Projects | 487.50 | 487.50 |

![]()

Total $ 2,095.93 $ 1,792.70

* Since the Legislature sets the rate, the District has limited flexibility in setting millage rates. The District is required to levy for the Required Local Effort and bases the compression adjustment on the assumption that the full Discretionary Millage is levied.

ADVERTISEMENT OF TENTATIVE BUDGET AND PROPOSED MILLAGE RATES

The Superintendent of Schools is responsible for recommending a tentative budget and proposed ad valorem property tax millage rates to the School Board. By law, the School Board must advertise a tentative budget and the proposed millage rates in a daily newspaper of general circulation in the County within 29 days after receiving the certification from the Property Appraiser. The advertisement contains a budget summary, proposed millage rates and a notice of the date and time of the first public hearing on the budget. The advertisement was published in the Tampa Bay Times on July 23, 2023. The tentative Budget Hearing is scheduled for July 25, 2023, at 6:00 p.m. in the School Board Meeting Room.

The County Property Appraiser notifies each property owner, usually in mid-August, of the amount of the property tax levies proposed by each taxing authority in the form of a "TRIM" Notice (Truth-In-Millage). This notice will show the actual tax levies for the prior year and the proposed tax levies for the current year. The tax notice will also inform the taxpayer of the date, time, and address of the final public hearing.

The second public hearing is required to be held at least 65 days, but not more than 80 days after receiving the tax roll certification from the Property Appraiser. After this public hearing, the School Board adopts a resolution stating the ad valorem property tax millage rates to be levied and adopts the final budget. The Final Public Hearing is scheduled for September 11, 2023, at 6:00 p.m., in the School Board Meeting Room.

The budgetary accounts of the District are grouped into funds in accordance with Generally Accepted Accounting Principles (GAAP) and standards prescribed by the Florida Department of Education. The Financial and Program Cost Accounting and Reporting for Florida Schools manual has established a modified accrual basis of accounting as the standard for governmental fund budgeting and reporting. All Florida school districts must adhere to this basis.

The budget document contains information for each of the funds or fund groups of the District for which a budget must be adopted. Budgetary control is maintained at the fund/function/object level. Each principal or department director is responsible for their respective budget. No expenditures are authorized for more than the budgetary appropriations. As with any projection, however, changes to appropriations are necessary to meet needs as they are identified. Therefore, budget amendments are prepared monthly and submitted to the School Board for approval.

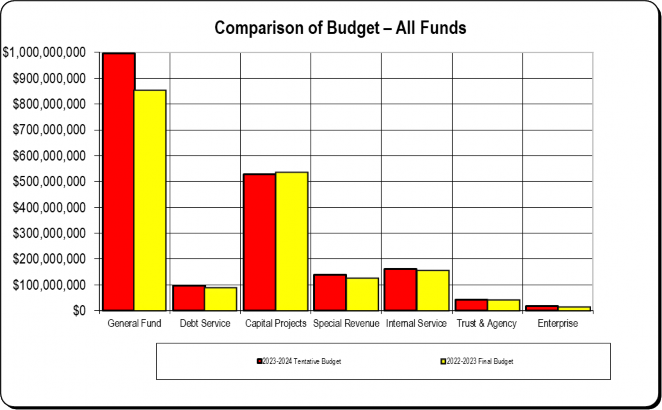

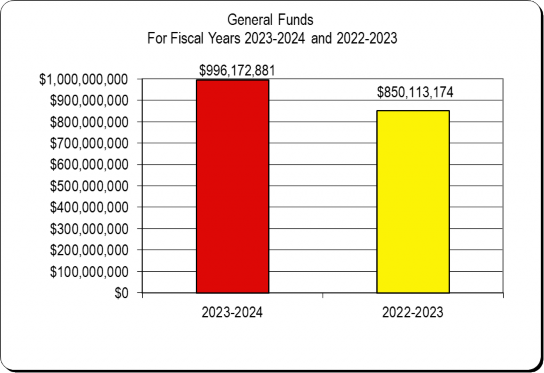

Comparison of Budget – All Funds

The total budget for all funds for the 2023-2024 fiscal year is $1,984,819,738. This is an increase of $178,207,508 or 9.9% from the 2022-2023 budget. The 2023-2024 total budget figure reflected below includes a General Fund operating budget of $996.2 million and a Capital Projects budget of $529.1 million.

The following schedule presents a comparison of the proposed budgets for all Governmental and Proprietary Funds of the District.

Fund Titles | 2023-2024 Tentative Budget | Total Funds 2022-2023 Final Budget | Increase (Decrease) Over 2022-2023 | % Increase (Decrease) |

General Fund | $996,172,881 | $850,113,174 | $146,059,707 | 17.2 % |

Debt Service | 96,515,971 | 87,838,918 | 8,677,053 | 9.9 % |

Capital Projects | 529,126,309 | 534,605,699 | (5,479,390) | (1.0) % |

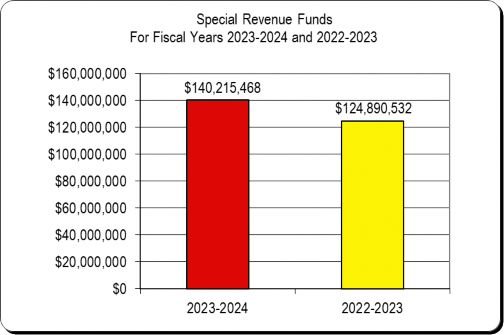

Special Revenue | 140,215,468 | 124,890,532 | 15,324,936 | 12.3 % |

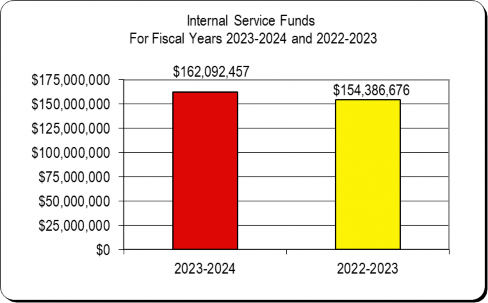

Internal Service | 162,092,457 | 154,386,676 | 7,705,781 | 5.0 % |

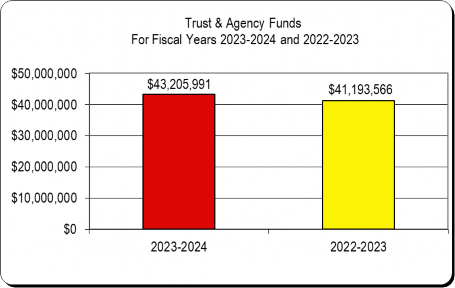

Trust & Agency | 43,205,991 | 41,193,566 | 2,012,425 | 4.9 % |

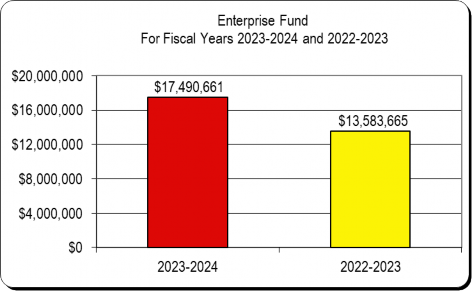

Enterprise | 17,490,661 | 13,583,665 | 3,906,996 | 28.8 % |

Total All Funds | $1,984,819,738

| $1,806,612,230

| $178,207,508

| 9.9 % |

The General Fund serves as the primary operating fund for the District and is the largest fund in the District’s budget. It includes all annual local and state funding along with federal funding, as well as the District’s required reserve funding. All general tax revenues and other receipts not allocated by law or by contractual agreement to another fund are accounted for in this fund. Daily operating costs such as personnel salaries and benefits, transportation, utilities, materials, and supplies are reflected in this fund.

The 2023-2024 budget for General Fund is $996,172,881, an increase of $146.0 million or 17.2% above the 2022-2023 budget.

Angeline Academy of Innovation is opening for the 2023-2024 school year and will be a 6th through 12th grade school, however, will open only serving 6th through 10th grade. The District also transitioned Mittye P. Locke Elementary to Mittye P. Locke Early Learning Academy, providing the Voluntary Prekindergarten Education Program (VPK) to prepare early learners for success in kindergarten and beyond. The District is estimating an increase of 2,985.46 full-time equivalent (FTE) students. The District's unassigned fund balance is in a strong position and exceeds the State’s three percent minimum requirement and the five percent goal established by the Board.

The District's financial stewardship is evidenced by a recent ratings upgrade by Fitch COPS ratings to “AA-“ from “A+” and the Issuer Default Rating (IDR) to “AA” from “AA-“. According to Fitch, this reflects a demonstrated multi-year trend of conservative budgeting practices and growth in fiscal reserve balances that has enabled the District to maintain an elevated level of financial flexibility through economic cycles. Fitch believes the district is well positioned to preserve its presently strong gap closing capacity, as supported by solid revenue growth prospects, moderate fixed carrying costs, and low long- term liabilities. The District's unrestricted general fund balance has historically equaled at least 9% of spending, providing solid financial resilience relative to its modest expected revenue volatility. Fitch believes that the district will continue to maintain reserves at similar or higher levels throughout the economic cycle, supported by its conservative budgeting and solid expenditure flexibility. In addition, the District’s rating by Moody’s is “A1” and by Standard & Poor’s is “A”. The Moody’s issuer rating of Aa3 reflects the district’s ability to repay debt and debt- like obligations without consideration of any pledge, security, or structural features.

In addition to providing a high-quality education to every child, the District has a variety of state and federal mandates to adhere to. A number of these requirements extend beyond the District’s primary mission of education; however, they are vital to the District’s role as a valued community partner. For example, the District provides facilities and staff members for

5

emergency shelters, operates the VPK Programs, works with other governmental entities to ensure appropriate community planning, feed children during the summer and contribute to the work of combating homelessness in the community. Even with limited resources, the District will continue to meet these obligations while prioritizing the needs of students as it works to streamline operations for maximum efficiency.

Resources to Support Operations

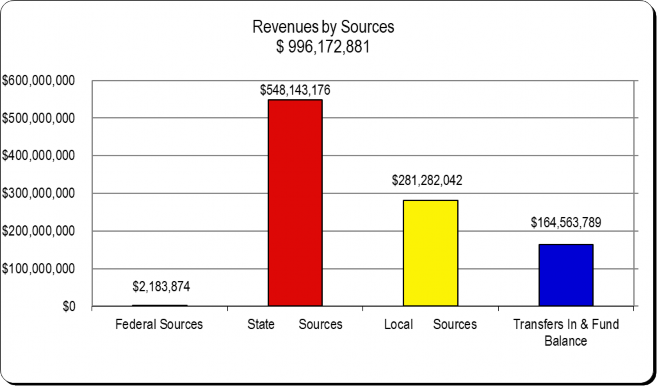

The District derives its operating income from a variety of federal, state, and local sources. The major categories of income sources for the General Fund are briefly described below. The District expects to receive 55.2% of the General Fund financial support from state and federal sources and 28.3% from local sources. The remaining 16.5% is comprised of transfers from other funds and carry forward fund balances (restricted and unrestricted).

State Support

This budget represents the funding level currently certified by the Department of Education, as of July 19, 2023.

Florida Education Finance Program Funding

The Florida Education Finance Program (FEFP) provides the funding for General Fund expenditures. The funding formula requires a combination of state and local funds to fund education. For 2023-2024, FEFP funds provided to Pasco County comprise a total of $750,392,299. Of that amount, the state is providing $542,387,310 and local property taxes are providing

$208,004,989.

The State of Florida’s base student allocation (BSA) increased from $4,587.40 to $5,139.73, an increase of $552.33 from the amount funded during 2022-2023. During the 2023 legislative session, significant changes were made to the FEFP, including the elimination of several state categorical programs. These categorical allocations are now rolled into the base student allocation resulting in a significant increase to the base. The requirements to fund previous categorical set asides remain, such as Classroom Teacher Supplies, Instructional Personnel Salary Increases, K-12 reading plans and instructional materials. Thus, the increase in the BSA does not translate to unrestricted access to the additional funding.

Included in the FEFP formula are allocations for Exceptional Student Education (ESE) totaling $35,008,315 to be used for educational programs and services for exceptional students. The Educational Enrichment Allocation, previously

Supplemental Academic Instruction, totaling $24,286,244 will be used to provide supplemental instruction, reading instruction, after-school instruction, tutoring, mentoring and for the extended school year program.

The Family Empowerment Scholarship (FES) is still retained within the district FEFP allocations and is estimated to be

$33,938,435. FES expands available school choice options for all students in Florida, thus the funds are considered a passthrough and removed with future budget amendments.

State Categorical Programs

The State designates a portion of FEFP funds for specific purposes, restricting the District’s discretionary use of these funds. A summary of the Categorical Funding, which remain restricted, is described below:

Categorical Funding | Amount |

Class Size Reduction | $81,953,549 |

Safe School | 6,271,677 |

Mental Health | 4,581,414 |

Educational Enrichment Allocation | 24,286,244 |

Total | $117,092,884 |

Local Support

The primary source of local revenue is ad valorem real and tangible personal property taxes. School Boards are not empowered to levy any other taxes. In addition, the District earns interest on cash invested and collects other miscellaneous revenues.

Budgeted revenues from ad valorem taxes are based on applying millage levies to 96% of the non-exempt assessed valuation of real and personal property within Pasco County. Local taxes are presently projected to be $208,004,989. The District is anticipating approximately $52,672,826 of local revenue upon the Board authorizing an additional 1 mil levy. The referendum funds will be used for staff supplements as stated above and a proportionate share will be provided to the charter schools and is estimated at $5.4 million.

Federal Sources

Federal revenue sources do not represent a significant portion of the District’s operating fund and are projected to decrease in the 2023-2024 fiscal year related to the processing of Medicaid claims.

Unweighted | Program | Weighted | Base | BASE | |||||

FTE | X | Cost Factors | = | FTE Students | X | Student Allocation | = | FUNDING | + |

Pasco | Pasco Avg. | Pasco | State | Pasco | |||||

88,536.21 | 1.103 | 97,656.77 | 5,139.73 | 501,929,430 | |||||

Safe | Mental | ESE | Educational | ||||||

Compression Adjustment | + | Schools Allocation | + | Health Allocation | + | Guaranteed Allocation | + | Enrichment Allocation | + |

Pasco | Pasco | Pasco | Pasco | Pasco | |||||

31,003,610 | 6,271,677 | 4,581,414 | 35,008,315 | 24,286,244 | |||||

State | Gross | ||||||||

DJJ Supplement | + | Transportation | + | Discretionary Supplement | = | State & Local FEFP | - | ||

Pasco | Pasco | Pasco | Pasco | ||||||

68,172 | 19,959,258 | 6,641,133 | 629,749,253 | ||||||

Required | Net | Categorical | TOTAL | ||||||

Local | State | Program | STATE | ||||||

Effort/ Proration | = | FEFP Allocation | + | Funds Allocation | = | FINANCE PROGRAM | |||

Pasco | Pasco | Pasco | Pasco | ||||||

169,315,492 | 460,433,761 | 81,953,549 | 542,387,310 |

Fiscal Year Program Cost Factors: 2023-2024 2022-2023

Program 101 - Basic Ed. Grades K-3 1.122 1.126

Program 102 - Basic Ed. Grades 4-8 1.000 1.000

Program 103 - Basic Ed. Grades 9-12 0.988 0.999

Program 111 - Basic Ed. Grades K-3 w/ ESE 1.122 1.126

Program 112 - Basic Ed. Grades 4-8 w/ ESE 1.000 1.000

Program 113 - Basic Ed. Grades 9-12 w/ ESE 0.988 1.010

Program 130 - ESOL 1.208 1.206

Program 254 - Exceptional Students Level IV 3.706 3.674

Program 255 - Exceptional Students Level V 5.707 5.401

Program 300 - Vocational Grades 9-12 1.072 0.999

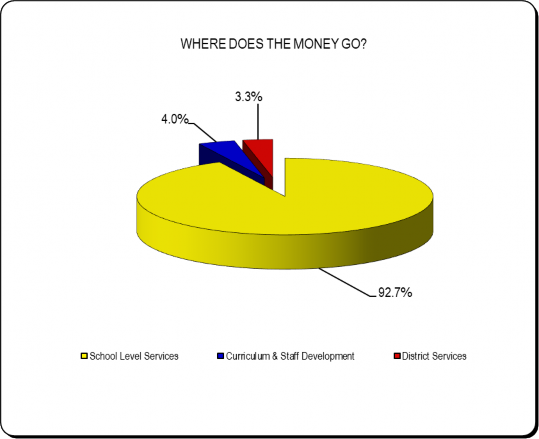

The largest portion of general fund resources are committed to conducting the educational programs offered to the residents of Pasco County.

Instruction combined with other school-level programs such as transportation, media, counseling, psychological services, school administration, community services, capital outlay and operations & maintenance comprises 92.7% of the operating budget.

Curriculum development and staff training comprise 4.0% of the operating budget.

District Services such as human resources, finance, purchasing, warehouse, data processing and mail services comprise 3.3% of the operating budget.

GENERAL FUND APPROPRIATIONS

% of Total

TOTALS Appropriations

![]()

SCHOOL LEVEL SERVICES

INSTRUCTION | $552,862,700 | 63.7% | |

STUDENT SERVICES [Includes counselors, psychologists, visiting teachers, instructional media and instruction-related technology] | 65,228,657 | 7.5% | |

TRANSPORTATION | 39,185,898 | 4.5% | |

SUB-TOTAL - DIRECT SERVICES TO STUDENTS | $657,277,255 | 75.7% | |

OPERATIONS & MAINTENANCE | $82,895,758 | 9.5% | |

SCHOOL ADMINISTRATION | 55,981,573 | 6.5% | |

COMMUNITY SERVICES | 966,151 | 0.1% | |

FOOD SERVICES | 312,298 | 0.0% | |

CAPITAL OUTLAY | 7,784,345 | 0.9% | |

SUB-TOTAL - INDIRECT SERVICES TO STUDENTS | $147,940,125 | 17.0% | |

TOTAL SCHOOL LEVEL SERVICES | $805,217,380 | 92.7% | |

CURRICULUM & STAFF DEVELOPMENT

INSTRUCTIONAL & CURRICULUM DEVELOPMENT | 29,634,667 | 3.4% |

INSTRUCTIONAL STAFF TRAINING | 5,264,973

| 0.6% |

![]()

![]()

![]()

TOTAL CURRICULUM & STAFF DEVELOPMENT $34,899,640 4.0% DISTRICT SERVICES

FISCAL SERVICES [includes accounting, budget, payroll, $3,986,979 0.5% accounts payable, and cash management]

CENTRAL SERVICES [includes purchasing, human 10,875,674 1.2%

resources, data processing and warehousing services]

ADMINISTRATIVE TECHNOLOGY SERVICES | 10,965,685 | 1.3% | |

SCHOOL BOARD | 719,693 | 0.1% | |

GENERAL ADMINISTRATION | 1,932,714 | 0.2% | |

TOTAL DISTRICT SERVICES | $28,480,745 | 3.3% | |

TOTAL APPROPRIATIONS | $868,597,765 | 100.0% | |

RESERVES/TRANSFERS | 127,575,116 | ||

TOTAL APPROPRIATIONS, RESERVES & TRANSFERS | $996,172,881 |

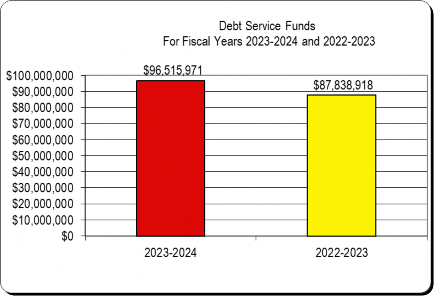

The Debt Service Fund is used to account for the accumulation of resources that are restricted, committed, or assigned for the payment of general long-term debt principal and interest. The District’s debt service funds are accounted for in five groups as follows:

State Board of Education Bond Fund - To account for payment of principal and interest on various bond issues serviced by the State of Florida on the District’s behalf.

District Revenue Bonds Fund – To account for payment of principal and interest on Motor Vehicle License Tax Revenue Bonds, which are secured by racetrack funds and jai alai fronton funds received annually by Pasco County pursuant to Chapter 79-548, Special Acts of 1979, Laws of Florida.

Debt Service Other Funds – To account for the accumulation of resources that are restricted, committed, or assigned for the payment of principal and interest on long-term obligations of the governmental funds.

The 2023-2024 budget for the Debt Service Fund is $96,515,971, an increase of $8.6 million or 9.9% above the 2022-2023 budget due to the terms of financing agreements and principal and interest payments.

The District must repay debt service prior to making any other expenditures. The principal and interest payments for fiscal year 2023-2024 are listed below:

Debt Service Type | Principal | Interest/Fees |

Certificates of Participation Notes | $23,219,593 | $22,981,358 |

Sales Tax Bond Funds | 20,105,000 | 1,202,599 |

Lease-Purchase Contracts | 10,018,958 | 387,399 |

State Board of Education Bond Funds | 632,000 | 135,030 |

Capital Improvement Revenue Bonds | 60,000 | 140,400 |

Total | $54,035,551

| $24,846,786 |

The District’s current financial arrangements are as follows: | |||

Interest | |||

Amount | Original | Rates Rang | |

Bond Type | Outstanding | Amount | (Percent) |

State School Bonds: | |||

Series 2014A, Refunding | $ 321,000 | $ 1,724,0 | |

Series 2017A, Refunding | 1,972,000 | ||

Series 2020A, Refunding | 610,0 | ||

District Revenue Bonds: | |||

Series 2013, Sales Tax | |||

Series 2016, Sales Tax Series 2018, Sal Series 2 | |||

S | |||

Total B | |||

Capital Projects Funds contain revenue from both sales tax and local property tax millage of 1.5 mils. The District uses funds for the acquisition and construction of major capital facilities, improvements to existing facilities, the maintenance of approximately 1,400 buildings across the County, and to account for the purchase of land, equipment, technology equipment, buses and motor vehicles. The district accounts for Capital funds as follows:

Public Education Capital Outlay (PECO) Fund – To account for Gross Receipts Taxes to be used for construction, remodeling, renovation, and site improvement of educational facilities.

District Revenue Bonds Fund – To account for special act bond proceeds to be used for construction, remodeling, renovation, and site improvement of educational facilities.

Capital Outlay and Debt Service Funds – To account for the excess dollars from the debt service funds used for construction and maintenance of schools. The District’s allocation from the state of Florida’s CO&DS Program is used to fund projects such as the construction of new schools, including capital equipment and additions to existing schools.

Local Capital Improvement Funds (Millage Funds) – To account for funds received from the assessment of property taxes for construction and maintenance of schools. The District’s Board can vote to levy up to 1.5 mills for use on projects advertised for expenditures listed in the 5-year capital plan on page 33. During the 2023 legislation the State passed HB 1259 requiring the District to share revenues from Capital Millage with Charter Schools. The amount provided is based on the Capital Outlay FTE. An initial allocation of 20% of the funds will be phased in with an increase of 20% per year over 5 years, the 2023-2024 charter school share is estimated to be $401,000.

Other Capital Funds – To account for the financial resources (e.g., certificates of participation, capital outlay sales tax, and capital leases) to be used for educational capital needs, including new construction and renovation and remodeling projects. The District accounts for School District impact fees used to increase student capacity, Pasco County Sales tax referendum - Penny for Pasco funds, and the expenditures related to sales tax bonds.

The 2023-2024 budget for the Capital Projects Funds is $529,126,309 which reflects a decrease of $5.5 million or 1.0% below the 2022-2023 budget.

Estimated Revenues

Revenue and other financing sources are comprised of Impact fees and the Capital Improvement Ad Valorem Tax Levy. On

March 9, 2004, a referendum election, “Sales Tax Referendum,” was held to determine whether the County could levy a one

(1) cent infrastructure sales surtax within the County. A majority of the voters of Pasco County voting in the Sales Tax Referendum approved the levy of the sales surtax commencing January 1, 2005. The sales surtax proceeds will be distributed to the District, the County, and the municipalities, with the District receiving 45%. The purpose is to build new schools and renovate existing facilities. The District established the Penny for Pasco Oversight Committee to help monitor the needs and allocation of funding. The projected revenue from “Penny for Pasco” is expected to generate approximately

$357.8 million that will be used to provide needed repairs and renovations to aging schools. It will also be used to improve energy efficiency in schools, retrofit and equip older schools built before 1975 with the technology students need to succeed in the 21st century. In calendar year 2022, “Penny for Pasco” generated over $45.9 million in revenue and is on target to exceed $47.7 million in calendar year 2023. A second renewal was placed on the ballot for the November 8, 2022, election and approved by the voters, extending the Penny for Pasco Surtax for another fifteen years.

Projected revenues by source are described below:

Projected Revenues | Amount |

Local Capital Improvement | $79,009,239 |

Impact Fees | 56,958,594 |

Sales Tax Proceeds | 48,268,781 |

Other Finaning Sources | 22,400,000 |

Interest on Investment | 6,197,949 |

Charter School Capital Outlay Funding | 4,457,781 |

Capital Outlay & Debt Service Distributed | 2,516,257 |

Total | $219,808,601 |

Capital Appropriations

A large portion of the Capital Project appropriations are for the major renovations of West Zephyrhills Elementary School, Starkey Ranch K-8 classroom wing, the construction of Kirkland Ranch K-8, Gulf High School, and the Angeline Athletic complex, along with Pasco High School classroom wing and a new southwest Land O’ Lakes K-8 school. Major projects include cafeteria renovations, replacement of HVAC systems, and infrastructure upgrades at various schools. Appropriations for capital debt service are to repay principal and interest payments for outstanding Certificates of Participation and Sales Tax Debt issues. Other uses of capital funds include maintenance and improvements of existing facilities, property insurance, capital equipment, technology, site acquisition, replacement of buses, vehicles, and portables.

Projected major appropriations and reserves are listed below:

Capital Projects | Amount |

New Schools | $69,364,000 |

Debt Service Payments | 57,791,378 |

Capital Maintenance Projects | 22,503,225 |

Sales Tax Debt Service Payments | 21,303,099 |

Major Remodel/Re-Development | 18,204,405 |

Property Insurance | 9,951,380 |

Equipment and Software | 8,922,155 |

Transfers to Charter Schools | 4,858,589 |

Buses and Motor Vehicles | 4,423,150 |

Land | 67,480 |

Total | $217,388,861 |

Special Revenue Funds are used to account for the proceeds of specific revenue sources (other than major capital projects) that are legally restricted or committed to expenditures for specific purposes.

Food and Nutrition Services (FNS) Fund – To account for food and nutrition services activities, including the serving of breakfast and lunch at schools. FNS operates during the regular school year, as well as during the summer at many schools. This fund depends on local sales and Federal and State programs for subsidizing school breakfast and lunch programs. The fund’s total budget is $86,568,254. During a normal school year, students attending brick and mortar schools’ fees are based on eligibility. The District serves more than 21,814 breakfasts, 36,971 lunches, and 1,400 suppers daily. Meal participation is expected to increase for the 2023-2024 school year once the District is approved to operate the Community Eligibility Provision program which offers free breakfast and lunch to all students. Meals are prepared and served at 80 sites. During the summer, the District provides on average 1,600 breakfasts, and 2,000 lunches daily to Pasco County students.

Other Federal Programs Fund – To account for the receipt and use of Federal grant proceeds. Currently, approximately $53.6 million in new federal funds is anticipated in the 2023-2024 school year.

The 2023-2024 budget for the Special Revenue Funds is $140,215,468, an increase of $15.3 million or 12.3% above the 2022-2023 budget.

The District received Coronavirus Response and Relief Supplemental Act (ESSER II) funds and continues to use these funds to support non-enrollment assistance, academic acceleration, and technology assistance. These grants are set to expire on September 30, 2023.

The District received American Rescue Plan (ESSER III) funds and continues to use these funds to recover from the impact COVID-19 had on schools in Florida and to ensure federal requirements are met. In doing so, the District has focused on in- person instruction, students’ academic and mental health needs all while addressing the opportunity gaps that existed before and were exacerbated by the pandemic. As such, this funding will mostly focus on supporting learning loss within the District and used to support Summer Learning Camps and High Impact Reading Interventions. These grants expire on September 30, 2024.

The amount received from Federal agencies is projected to be $53,647,214 and will be used to serve all Pasco students who qualify for the following programs:

The District has established Internal Service Funds to account for activity within the school district providing goods and services to other funds, departments, and agencies.

Self-Insurance Funds – To account for the District’s fully self-insured employee group health and assistance program, casualty liability and workers’ compensation programs. The total budget for these programs is

$140,274,294.

Other Internal Service Funds – To account for the Energy Management, Water Management, Waste Management and Exclusive Agreement Programs. The total budget for these programs is $21,818,163.

The 2023-2024 budget for the Internal Service Funds is $162,092,457 which reflects an increase of $7.7 million or 5.0% above the 2022-2023 budget.

The District contributes $8,125 per employee per year for employees’ medical, life and flexible benefits. The District contribution has increased from $6,036 in calendar year 2013 to $8,125 in calendar year 2023. This represents an increase of 34.6% since 2013. The total amount projected to pay premiums in fiscal year 2023-2024 is $79,022,121. The contribution for premiums for the casualty liability, workers’ compensation claims and administrative costs is $6,131,357. The District also operates six Health and Wellness Centers, to help defray costs associated with health care for employees and workers’ compensation services.

Trust and Agency Funds are used to account for resources held by the school district as a custodian.

Private-purpose Trust Funds – To account for resources of various scholarship funds providing medical benefits and educational support. The budget for these funds totals $144,291.

Pension Trust Fund – To account for the Early Retirement Plan providing eligible employees, who elect to retire early retirement provisions, with a monthly benefit equal to the statutory reduction of the normal retirement benefits when early retirement precedes the normal retirement age of 62. The program is closed to new participants; however, it will remain open until final payments are made to all current participants. The total budget for this fund is $13,172,735.

School Internal Funds – To account for financial resources collected by the schools and held by the District as a custodian, which will be used for school and student athletic activities, class activities and club activities. The total budget for this fund is $29,888,965.

The 2023-2024 budget for the Trust and Agency Funds is $43,205,991, an increase of $2.0 million or 4.9% above the 2022- 2023 budget.

The Enterprise Fund is a completely self-supporting activity and receives no funding from property taxes or any other District fund.

After School Enrichment Program (ASEP) Fund – To account for the financial resources of the extended day program of the District. ASEP will operate in 34 elementary schools during the regular 2023-2024 fiscal year and is expected to serve approximately 3,300 students during the school year and summer months.

Vending program Fund – To account for the operations of the food and beverage machines throughout the District.

The 2023-2024 budget for the Enterprise Fund is $17,490,661, an increase of $3.9 million or 28.8% above the 2022-2023 budget.

The budget is designed to ensure the smooth delivery of effective school operations while prioritizing the needs of Pasco’s students and the community. It is important for the District to have the flexibility to adapt to changing conditions during the year and to provide adequate reserves for the future. The budget development process reflects State mandates, School Board actions, and careful planning. Budget development, review, and consideration were completed with a detailed analysis of every revenue and expenditure category within the context of the School Board’s goals, mission, and financial policies.

As with any projection, this budget will change during the year as needs develop and critical areas are identified. Budget amendments will be submitted to the School Board for approval during the year to make the best use of available resources and maximize opportunities for the students of Pasco County. I hereby submit and recommend this budget to the Pasco County School Board for the fiscal year 2023-2024.

Respectfully,

Kurt S. Browning Superintendent of Schools

Tammy Taylor, MBA Chief Finance Officer

Michelle Williams

Director of Finance Services

DISTRICT SCHOOL BOARD OF PASCO COUNTY BUDGET SUMMARY

FISCAL YEAR 2023-2024

THE PROPOSED OPERATING BUDGET EXPENDITURES OF THE DISTRICT SCHOOL BOARD OF PASCO COUNTY ARE 9.9% MORE THAN LAST YEAR'S OPERATING EXPENDITURES

PROPOSED MILLAGE LEVIES SUBJECT TO 10-MILL CAP: | |||

REQUIRED LOCAL EFFORT | 3.201 | BASIC DISCRETIONARY OPERATING | 0.748 |

PRIOR PERIOD ADJUSTMENT | 0.000 | DISCRETIONARY CRITICAL NEEDS (OPERATING) | 0.000 |

BASIC DISCRETIONARY CAPITAL OUTLAY | 1.500 | ADDITIONAL DISCRETIONARY (STATUTORY, VOTED) | 1.000 |

ADDITIONAL DISCRETIONARY CAPITAL OUTLAY | 0.000 | DEBT SERVICE (VOTED) | 0.000 |

TOTAL MILLAGE | 6.449 | ||

DEBT | CAPITAL | SPECIAL | INTERNAL | TRUST & | GRAND | ||

GENERAL | SERVICE | PROJECTS | REVENUE | SERVICE | AGENCY | ENTERPRISE | TOTAL |

REVENUES

Federal | 2,183,874 | 566,574 | 93,227,214 | 95,977,662 | ||||

State Sources Local Sources TOTAL REVENUES Transfers In Nonrevenue Sources FUND BALANCES - JULY 1, 2023 TOTAL REVENUES AND BALANCES | 548,143,176 | 1,107,568 | 6,974,038 | 406,716 | 556,631,498 | |||

281,282,042 | 140,882 | 212,834,563 | 9,054,827 | 108,162,451 | 17,874,153 | 10,843,782 | 640,192,700 | |

831,609,092 | 1,815,024 | 219,808,601 | 102,688,757 | 108,162,451 | 17,874,153 | 10,843,782 | 1,292,801,860 | |

5,367,789 | 79,094,477 | 9,951,380 | 94,413,646 | |||||

50,000 | 158,000 | 208,000 | ||||||

159,146,000 | 15,606,470 | 309,317,708 | 37,526,711 | 43,820,626 | 25,331,838 | 6,646,879 | 597,396,232 | |

996,172,881 | 96,515,971 | 529,126,309 | 140,215,468 | 162,092,457 | 43,205,991 | 17,490,661 | 1,984,819,738 |

22

EXPENDITURES

Instruction Student Support Services Instructional Media Services Instructional & Curriculum Development Services Instructional Staff Training Instruction-Related Technology Board General Administration School Administration Facilities Acquisition Construction Fiscal Services Food Services Central Services Student Transportation Services Operation of Plant Maintenance of Plant Administrative Technology Services Community Services Debt Service Internal Funds Disbursements TOTAL EXPENDITURES Transfers Out FUND BALANCES - JUNE 30, 2024 TOTAL EXPENDITURES TRANSFERS & BALANCES | 552,862,700 | 28,306,551 | 138,757 | 16,303 | 581,324,311 | |||

50,181,127 | 15,102,997 | 65,284,124 | ||||||

2,734,955 | 2,734,955 | |||||||

29,634,667 | 4,709,081 | 34,343,748 | ||||||

5,264,973 | 2,446,693 | 7,711,666 | ||||||

12,312,575 | 10,180 | 12,322,755 | ||||||

719,693 | 1,447,000 | 2,166,693 | ||||||

1,932,714 | 2,089,460 | 1,300 | 4,023,474 | |||||

55,981,573 | 239,470 | 320,313 | 56,541,356 | |||||

7,784,345 | 123,484,415 | 131,268,760 | ||||||

3,986,979 | 77,528 | 110,725 | 4,175,232 | |||||

312,298 | 48,162,738 | 48,475,036 | ||||||

10,875,674 | 309,402 | 113,751,233 | 124,936,309 | |||||

39,185,898 | 275,123 | 39,461,021 | ||||||

66,860,326 | 19,418,787 | 86,279,113 | ||||||

16,035,432 | 55,641 | 16,091,073 | ||||||

10,965,685 | 80,729 | 11,046,414 | ||||||

966,151 | 40,342 | 39,000 | 10,324,497 | 11,369,990 | ||||

78,882,337 | 78,882,337 | |||||||

19,040,000 | 19,040,000 | |||||||

868,597,765 | 78,882,337 | 123,484,415 | 101,809,952 | 133,837,098 | 20,542,303 | 10,324,497 | 1,337,478,367 | |

93,904,446 | 509,200 | 94,413,646 | ||||||

127,575,116 | 17,633,634 | 311,737,448 | 38,405,516 | 27,746,159 | 22,663,688 | 7,166,164 | 552,927,725 | |

996,172,881 | 96,515,971 | 529,126,309 | 140,215,468 | 162,092,457 | 43,205,991 | 17,490,661 | 1,984,819,738 |

THE TENTATIVE, ADOPTED, AND/OR FINAL BUDGETS ARE ON FILE IN THE OFFICE OF THE ABOVE- MENTIONED TAXING AUTHORITY AS A PUBLIC RECORD

The District School Board of Pasco County has tentatively adopted a measure to increase its property tax levy.

Last year’s property tax levy:

Initially proposed tax levy… $257,264,225

Less tax reductions due to Value Adjustment Board and other assessment changes ($276,237)

Actual property tax levy $257,540,462

This year’s proposed tax levy $353,840,681

A portion of the tax levy is required under state law in order for the school board to receive $542,387,310 in state education grants.

The required portion has increased by 9.65 percent, and represents approximately five tenths of the total proposed taxes.

The remainder of the taxes is proposed solely at the discretion of the school board.

All concerned citizens are invited to a public hearing on the tax increase to be held on July 25, 2023 at 6:00 p.m. in the School Board Meeting Room at the District Office located at 7205 Land O’Lakes Boulevard, Land O’Lakes, FL 34638.

A DECISION on the proposed tax increase and the budget will be made at this hearing.

23

The District School Board of Pasco County will soon consider a measure to continue to impose a 1.500 mill property tax for the capital outlay projects listed herein.

This tax is in addition to the school board's proposed tax of 4.949 mills for operating expenses and is proposed solely at the discretion of the school board.

THE PROPOSED COMBINED SCHOOL BOARD TAX INCREASE FOR BOTH OPERATING EXPENSES AND CAPITAL OUTLAY IS SHOWN IN THE ADJACENT NOTICE.

The capital outlay tax will generate approximately $79,009,239 to be used for the following projects:

CONSTRUCTION AND REMODELING

Portables - Various Sites

MAINTENANCE, RENOVATION, AND REPAIR

HVAC - Various Sites | Security Systems - Various Sites | Fire Alarm Upgrades – Various Sites |

School-wide Telephones - Various Sites | Site Improvements - Various Sites | Flooring Replacements – Various Sites |

Renovations - Various Sites | Paving Improvements - Various Sites | Hurricane Enhancements – Various Sites |

Roofing - Various Sites | Athletic Improvements - Various Sites | Site Compliance – Various Sites |

Technology Retrofits - Various Sites | Fuel Tank Repairs – Various Sites | Traffic Safety Improvements – Various Sites |

Health and Safety Retrofits – Various Sites | Fire Safety – Various Sites | Energy Retrofits – Various Sites |

MOTOR VEHICLE PURCHASES Purchase of 28 school buses | Purchase of fleet vehicles |

NEW AND REPLACEMENT EQUIPMENT, COMPUTER AND DEVICE HARDWARE AND OPERATING SYSTEM SOFTWARE NECESSARY FOR GAINING ACCESS TO OR ENHANCING THE USE OF ELECTRONIC AND DIGITAL INSTRUCTIONAL CONTENT AND RESOURCES, AND ENTERPRISE RESOURCE SOFTWARE

Purchase of new computers - Various Schools & Sites Purchase of Furniture/Fixtures/Equipment/Hardware - Various Schools & Sites Purchase of new tablets - Various Schools & Sites Purchase of software - Various Schools & Sites

PAYMENTS FOR EDUCATIONAL FACILITIES AND SITES DUE UNDER A LEASE-PURCHASE AGREEMENT

US Bank (Debt Service on Certificates of Participation)

PAYMENT OF COSTS OF COMPLIANCE WITH ENVIRONMENTAL STATUTES, RULES, AND REGULATIONS

May include but not limited to (Asbestos Abatement, Radon Testing, Hazardous Waste Disposal, Environmental Auditing of Land Acquisitions, Indoor Air Quality Tests, and Water Testing to Comply with Clean Water Act)

PAYMENT OF PREMIUMS FOR PROPERTY AND CASUALTY INSURANCE NECESSARY TO INSURE THE EDUCATIONAL AND ANCILLARY PLANTS OF THE SCHOOL DISTRICT

Insurance premiums on district facilities

PAYMENT OF COSTS OF LEASING RELOCATABLE EDUCATIONAL FACILITIES

Leasing of portable classrooms – Various Sites

CHARTER SCHOOL CAPITAL OUTLAY PROJECTS PURSUANT TO S. 1013.62(4), F.S.

PURCHASE OF REAL PROPERTY CONSTRUCTION OF SCHOOL FACILITIES

PURCHASE OR LEASE OF PERMANENT OR RELOCATABLE SCHOOL FACILITIES PURCHASE OF VEHICLES TO TRANSPORT STUDENTS

RENOVATION, REPAIR, AND MAINTENANCE OF SCHOOL FACILITIES

PAYMENT OF THE COST OF PREMIUMS FOR PROPERTY AND CASUALTY INSURANCE NECESSARY TO INSURE SCHOOL FACILITIES

PURCHASE OR LEASE OF DRIVER'S EDUCATION VEHICLES, MAINTENANCE VEHICLES, SECURITY VEHICLES, OR VEHICLES USED IN STORING OR DISTRIBUTING MATERIALS AND EQUIPMENT

COMPUTER AND DEVICE HARDWARE AND OPERATING SYSTEM SOFTWARE NECESSARY FOR GAINING ACCESS TO OR ENHANCING THE USE OF ELECTRONIC AND DIGITAL INSTRUCTIONAL CONTENT AND RESOURCES, AND ENTERPRISE RESOURCE SOFTWARE

PAYMENT OF COSTS OF OPENING DAY COLLECTION FOR LIBRARY MEDIA CENTER

All concerned citizens are invited to a public hearing to be held on July 25, 2023, at 6:00 p.m. at the school Board Meeting Room in the District Office located at

7205 Land O' Lakes Boulevard Land O' Lakes, FL 34638

A DECISION on the proposed CAPITAL OUTLAY TAXES will be made at this hearing.

24

DISTRICT SCHOOL BOARD OF PASCO COUNTY

MILLAGE LEVY FOR CAPITAL OUTLAY AND GENERAL OPERATIONS

FISCAL YEAR

CAPITAL OUTLAY TAX MILLAGE

GENERAL OPERATIONS TAX MILLAGE

COMBINED TOTAL

1971-72 | 10.000 | mills | 10.000 | mills | ||

1972-73 | 10.000 | mills | 10.000 | mills | ||

1973-74 | 10.000 | mills | 10.000 | mills | ||

1974-75 | 8.000 | mills | 8.000 | mills | ||

1975-76 | 8.000 | mills | 8.000 | mills | ||

1976-77 | 8.000 | mills | 8.000 | mills | ||

1977-78 | 8.000 | mills | 8.000 | mills | ||

1978-79 | 8.000 | mills | 8.000 | mills | ||

1979-80 | 6.750 | mills | 6.750 | mills | ||

1980-81 | 1.359 | mills | 6.005 | mills | 7.364 | mills |

1981-82 | 1.359 | mills | 6.112 | mills | 7.471 | mills |

1982-83 | 0.965 | mills | 5.478 | mills | 6.443 | mills |

1983-84 | 0.943 | mills | 5.500 | mills | 6.443 | mills |

1984-85 | 0.943 | mills | 5.526 | mills | 6.469 | mills |

1985-86 | 1.500 | mills | 5.626 | mills | 7.126 | mills |

1986-87 | 1.500 | mills | 5.942 | mills | 7.442 | mills |

1987-88 | 1.000 | mills | 5.890 | mills | 6.890 | mills |

1988-89 | 0.851 | mills | 6.203 | mills | 7.054 | mills |

1989-90 | 1.453 | mills | 6.364 | mills | 7.817 | mills |

1990-91 | 1.503 | mills | 6.756 | mills | 8.259 | mills |

1991-92 | 1.503 | mills | 6.911 | mills | 8.414 | mills |

1992-93 | 1.503 | mills | 7.084 | mills | 8.587 | mills |

1993-94 | 2.000 | mills | 7.128 | mills | 9.128 | mills |

1994-95 | 2.000 | mills | 7.282 | mills | 9.282 | mills |

1995-96 | 2.000 | mills | 7.418 | mills | 9.418 | mills |

1996-97 | 2.000 | mills | 7.228 | mills | 9.228 | mills |

1997-98 | 2.000 | mills | 7.105 | mills | 9.105 | mills |

1998-99 | 2.000 | mills | 7.218 | mills | 9.218 | mills |

1999-00 | 2.000 | mills | 6.894 | mills | 8.894 | mills |

2000-01 | 2.000 | mills | 6.644 | mills | 8.644 | mills |

2001-02 | 2.000 | mills | 6.382 | mills | 8.382 | mills |

2002-03 | 2.000 | mills | 6.365 | mills | 8.365 | mills |

2003-04 | 2.000 | mills | 6.382 | mills | 8.382 | mills |

2004-05 | 1.500 | mills | 6.080 | mills | 7.580 | mills |

2005-06 | 1.500 | mills | 6.013 | mills | 7.513 | mills |

2006-07 | 1.500 | mills | 5.681 | mills | 7.181 | mills |

2007-08 | 1.500 | mills | 5.522 | mills | 7.022 | mills |

2008-09 | 1.500 | mills | 5.708 | mills | 7.208 | mills |

2009-10 | 1.500 | mills | 5.840 | mills | 7.340 | mills |

2010-11 | 1.500 | mills | 6.267 | mills | 7.767 | mills |

2011-12 | 1.500 | mills | 6.144 | mills | 7.644 | mills |

2012-13 | 1.500 | mills | 5.841 | mills | 7.341 | mills |

2013-14 | 1.500 | mills | 5.857 | mills | 7.357 | mills |

2014-15 | 1.500 | mills | 5.649 | mills | 7.149 | mills |

2015-16 | 1.500 | mills | 5.609 | mills | 7.109 | mills |

2016-17 | 1.500 | mills | 5.277 | mills | 6.777 | mills |

2017-18 | 1.500 | mills | 5.065 | mills | 6.565 | mills |

2018-19 | 1.500 | mills | 4.779 | mills | 6.279 | mills |

2019-20 | 1.500 | mills | 4.601 | mills | 6.101 | mills |

2020-21 | 1.500 | mills | 4.422 | mills | 5.922 | mills |

2021-22 | 1.500 | mills | 4.310 | mills | 5.810 | mills |

2022-23 | 1.500 | mills | 4.016 | mills | 5.516 | mills |

2023-24* | 1.500 | mills | 4.949 | mills | 6.449 | mills |

* Proposed |

DISTRICT SCHOOL BOARD OF PASCO COUNTY GENERAL OPERATING FUND

REVENUES AS A PERCENTAGE OF TOTAL OPERATING BUDGET 2023-2024 FISCAL YEAR

AMOUNT OF TOTAL

FEDERAL

ROTC | $ | 683,874 |

OTHER | 1,500,000 |

0.1% |

0.2% |

Florida Education Finance |

Program (State Portion) |

State Categoricals |

Other State Revenues |

460,433,761 |

81,953,549 |

5,755,866 |

46.1% |

8.2% |

0.6% |

Required Local Effort, |

Discretionary |

Voted Tax |

208,004,989 |

52,672,826 |

20.9% |

5.3% |

LOCAL - OTHER Miscellaneous Local & Interest | 20,604,227 | 2.1% |

NONREVENUE | 50,000 | 0.0% |

TRANSFERS | 5,367,789 | 0.5% |

FUND BALANCE Fund Balance | 159,146,000 | 16.0% |

GRAND TOTAL OF FUNDS AVAILABLE | ||

FOR APPROPRIATIONS FOR | ||

2023-2024 | $ | 996,172,881 |

100.0%

![]()

![]()

PROJECTED |

BUDGET |

DESCRIPTION APPROPRIATIONS

TOTAL SALARIES | $ 469,248,818 |

SALARIES

Retirement | 62,005,527 |

Social Security | 35,010,610 |

Group Insurance | 68,783,365 |

Worker's Comp | 5,938,814 |

Unemployment Comp | 480,452 |

BENEFITS

TOTAL BENEFITS | 172,218,768 |

Additional salaries and benefits are reported in categorical and district programs | ||

Educational Enrichment Allocation (SAI) | 24,859,517 | |

Safe School | 6,548,072 | |

Mental Health | 4,092,640 | |

Instructional Materials & Textbook | 5,625,678 | |

ESE APPS | 125,000 | |

Media & Library Allocation | 232,468 | |

Dual Enrollment Textbooks | 480,000 | |

Supplemental K-12 Reading | 4,674,004 | |

AP, Dual Enrollment, AICE, IB and Industry Certification | 11,110,112 | |

Teacher Supply Assistance | 1,400,000 | |

State Grants | 517,980 | |

Family Empowerment Scholarships | 33,938,435 | |

TOTAL STATE FUNDING & SET ASIDE | 93,603,906.00 | |

Charter Schools | 75,358,190 | |

TOTAL SCHOOL CHOICE PROGRAMS | 75,358,190 | |

TOTAL SALARIES AND BENEFITS 641,467,586

STATE FUNDING & SET ASIDE

Baycare | 44,000 |

TOTAL FTE CONTRACTS | 44,000 | |

Telephone | 200,000 | |

Water & Sewer | 3,000,000 | |

Electric | 13,500,000 | |

Utilities/Other | 135,100 | |

Garbage Collection Fees | 1,500,000 | |

Wireless Network | 700,000 | |

TOTAL UTILITIES | 19,035,100 |

SCHOOL CHOICE PROGRAMS FTE CONTRACTS

UTILITIES

PROJECTED |

BUDGET |

DESCRIPTION APPROPRIATIONS

MAINTENANCE & REPAIRS In-House Maintenance 3,500,000

Outside Maintenance 1,113,604

Tech Services Repairs 500,000

Schoolwide Telephone Maintenance 745,000

District-Wide Copy Machines 1,044,745

Laser Printers/Owned 421,000

Athletic Field & Maintenance 130,880

Custodial Maintenance 369,850

TOTAL MAINTENANCE & REPAIRS 7,825,079

BUS TRANSPORTATION Bus & Motor Vehicle Maintenance 1,400,215

Gas & Diesel 5,561,725

District-Wide Transportation 600,360

TOTAL BUS TRANSPORTATION 7,562,300

MISCELLANEOUS EXPENDITURES Professional & Technical Services 3,867,759

Security Services 50,000

Communications 392,353

Travel 446,280

Insurance Premium 2,454,640

Purchased Services 814,070

Printing 184,285

Materials & Supplies 988,838

Other Expenses 1,919,923

Speech Therapy Services 255,675

Use of Facilities-Reimburse Schools 55,000

TOTAL MISCELLANEOUS EXPENDITURES 11,428,823

SCHOOLS ALLOCATIONS Allocation per Teacher Unit 5,292,483

School Media 450,753

Principals' Travel 32,670

Comparability 210,873

CTE Non-Discretionary 277,503

TOTAL SCHOOLS' ALLOCATIONS 6,264,282

DISTRICT PROGRAMS Adults with Disabilities 21,803

All County Music 22,572

Alternative Certification 119,270

Athletic Officials/Transportation 600,000

Attorney Fees 557,300

Band Uniform Allocation 115,000

Blended Learning 441,500

Career Academies 52,087

Certified Athletic Trainers 400,000

Choral Allocation 30,000

District End of Course Exams 174,134

Early College Program 14,500

Fingerprinting 245,700

Fingerprinting Students to Work Program 5,000

Florida Music Association Dues 13,000

Gifted Program 7,819

General Paper 893,000

Health Services 20,000

DESCRIPTION | APPROPRIATIONS | |

Instrument Repair Program | 100,000 | |

Local Assessments | 42,726 | |

Magnet Schools | 613,203 | |

Mental Health Contracts | 80,000 | |

Middle School Course Recovery | 75,000 | |

Music Transportation | 70,000 | |

Odyssey of the Mind | 4,500 | |

Pasco's Vision - Elementary | 20,000 | |

Pasco's Vision - Secondary | 20,000 | |

Physical and Occupational Therapy Services | 22,500 | |

Positive Coaching Trainers | 109,200 | |

Professional Certification Renewal | 30,000 | |

Professional Certification Replacements | 18,000 | |

Professional Development | 287,217 | |

Professional Educational Competency | 241,800 | |

Recruitment Program | 327,900 | |

Regular Education Home Instruction | 1,920 | |

School Events | 84,398 | |

Teacher Assistance Program | 5,000 | |

Temporary Personnel Services | 25,000 | |

TOOLS | 44,575 | |

Vocational National Competition | 30,600 | |

World Language | 22,275 |

PROJECTED |

BUDGET |

TOTAL DISTRICT PROGRAMS 6,008,499

2023-2024 TOTAL APPROPRIATIONS $868,597,765

THIS PAGE INTENTIONALLY LEFT BLANK.

BUDGET SUMMARY |

GENERAL OPERATING FUND |

2023-2024 |

BUDGET |

2022-2023 |

BUDGET |

ESTIMATED REVENUE:

Federal | 2,183,874 |

State - FEFP | 460,433,761 |

State - Other | 87,709,415 |

Local - Taxes | 260,677,815 |

Local - Other | 20,604,227 |

Non-Revenue Sources | 50,000 |

Incoming Transfers | 5,367,789 |

2,883,217 |

429,915,432 |

88,226,061 |

179,812,582 |

12,313,150 |

- |

4,548,045 |

RESERVES:

Fund Balance | 159,146,000 |

TOTAL ESTIMATED REVENUE AND | |

FUND BALANCE | 996,172,881

|

APPROPRIATIONS:

Salaries & Benefits | 674,134,017 |

Purchased Services | 150,440,874 |

Energy Services | 17,796,610 |

Materials and Supplies | 21,438,821 |

Capital Outlay | 678,266 |

Other Expenses | 4,109,177 |

RESERVES:

132,414,687

850,113,174

![]()

564,989,237 |

136,140,551 |

16,777,610 |

20,676,816 |

752,752 |

4,252,124 |

Fund Balance | 127,575,116 |

106,524,084

TOTAL APPROPRIATIONS AND | |

FUND BALANCE | 996,172,881 |

850,113,174

![]()

![]()

BUDGET SUMMARY |

DEBT SERVICE FUNDS |

2023-2024 |

BUDGET |

2022-2023 |

BUDGET |

ESTIMATED REVENUE:

Federal | 566,574 |

State | 1,107,568 |

Local | 140,882 |

Incoming Transfers | 79,094,478 |

Nonrevenue Sources | - |

500,000 |

1,107,568 |

2,688 |

71,529,314 |

877,475 |

RESERVES:

Fund Balance | 15,606,470 |

TOTAL ESTIMATED REVENUE AND | |

FUND BALANCE | 96,515,972

|

APPROPRIATIONS:

Payment on Bonds and Loans | 54,035,551 |

Interest | 24,762,286 |

Dues and Fees | 84,500 |

RESERVES:

13,821,873

87,838,918

![]()

47,481,317 |

24,329,382 |

990,475 |

Fund Balance | 17,633,635 |

15,037,744

TOTAL APPROPRIATIONS AND | |

FUND BALANCE | 96,515,972 |

87,838,918

![]()

![]()

BUDGET SUMMARY |

CAPITAL PROJECTS FUNDS |

2023-2024 |

BUDGET |

2022-2023 |

BUDGET |

ESTIMATED REVENUE:

State | 6,974,038 |

Local | 212,834,563 |

Incoming Transfers | - |

Bond Proceeds | - |

Capital Lease | - |

7,291,642 |

171,496,392 |

2,093,010 |

95768717 |

10,079,155 |

RESERVES:

Fund Balance | 309,317,708 |

TOTAL ESTIMATED REVENUE AND | |

FUND BALANCE | 529,126,309

|

APPROPRIATIONS:

Building & Fixed Equipment | 82,464,000 |

Furniture, Fixtures & Equipment | 6,297,832 |

Motor Vehicles/Buses | 4,423,150 |

Land | 67,480 |

Improvements Other than Building | 5,432,645 |

Remodeling | 21,999,308 |

Computer Software | 2,800,000 |

Dues & Fees | - |

Outgoing Transfers | 93,904,446 |

RESERVES:

247,876,783

534,605,699

![]()

207,871,147 |

17,059,504 |

5,710,994 |

6,657,200 |

11,281,302 |

22,234,569 |

3,597,799 |

500,000 |

80,709,232 |

Fund Balance | 311,737,448 |

178,983,952

TOTAL APPROPRIATIONS AND | |

FUND BALANCE | 529,126,309 |

534,605,699

![]()

![]()

Change in revenues over the next 5 years has been estimated as follows:

SCHOOL BOARD OF PASCO COUNTY | ||||||||||

FIVE YEAR CAPITAL PLAN | ||||||||||

CURRENT REVENUE - RATE OF CHANGE (PERCENTAGE) | ||||||||||

Budget FY 23/24 | Budget FY 24/25 | Budget FY 25/26 | Budget FY 26/27 | Budget FY 27/28 | ||||||

ESTIMATED REVENUE Current Revenue - Local | ||||||||||

PROPERTY TAX MILLAGE COLLECTIONS | $ 79,009,239 | $ 82,959,701 | $ 87,107,686 | $ 91,463,070 | $ 96,036,224 | |||||

% Inc/(Dec) | 17.2% | 5.0% | 5.0% | 5.0% | 5.0% | |||||

IMPACT FEE COLLECTIONS | 56,958,594 | 57,528,180 | 58,103,462 | 58,684,497 | 59,271,342 | |||||

% Inc/(Dec) | 2.0% | 1.0% | 1.0% | 1.0% | 1.0% | |||||

SALES TAX COLLECTIONS | 48,268,781 | 49,475,500 | 50,712,388 | 51,980,198 | 53,279,703 | |||||

% Inc/(Dec) | 2.5% | 2.5% | 2.5% | 2.5% | 2.5% | |||||

INTEREST | 6,197,949 | 1,310,000 | 1,210,000 | 1,210,000 | 1,210,000 | |||||

% Inc/(Dec) | -20.3% | -78.9% | -7.6% | 0.0% | 0.0% | |||||

Local Revenue Total: | $ 190,434,563 | $ 191,273,381 | $ 197,133,536 | $ 203,337,765 | $ 209,797,269 | |||||

Current Revenue - State | ||||||||||

CO & DS DISTRIBUTION per DOE ESTIMATE | $ 2,467,310 | $ 2,467,310 | $ 2,467,310 | $ 2,467,310 | $ 2,467,310 | |||||

% Inc/(Dec) | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | |||||

CO & DS INTEREST/UNDISTRIBUTED per DOE ESTIMATE | 48,947 | 48,947 | 48,947 | 48,947 | 48,947 | |||||

% Inc/(Dec) | 0.0% | 0.0% | n/a | n/a | n/a | |||||

PECO (Charter Schools) | 4,457,781 | - | - | - | - | |||||

% Inc/(Dec) | -0.3% | n/a | n/a | n/a | n/a | |||||

State Revenue Total: | $ | 6,974,038 | $ | 2,516,257 | $ | 2,516,257 | $ | 2,516,257 | $ | 2,516,257 |

Non Revenue Source | ||||||||||

OTHER FINANCING SOURCES | $ 22,400,000 | $ - $ - $ - $ - | ||||||||

% Inc/(Dec) | 0.0% | n/a n/a n/a n/a | ||||||||

Non- Revenue Source Total: | $ 22,400,000 | $ - $ - $ - $ - | ||||||||

Description of the impact on the Operating Budget from Major Capital Projects:

Renovation - Major renovation projects have been started, or are being completed on four elementary schools, one middle school, four high schools, and two district facilities within this budget year.

New Construction - Seven sites are planned to complete construction/additions within the district this budget year.

Repair Projects - Numerous repair projects planned in this budget year.

FY 24/25 | FY 25/26 | FY 26/27 | FY 27/28 | Total | ||

REVENUES | ||||||

Property Tax Millage Collections |

$ 79,009,239 | $ 82,959,701 | $ 87,107,686 | $ 91,463,070 | $ 96,036,224 | $ 436,575,920 |

Impact Fee Collections | 56,958,594 | 57,528,180 | 58,103,462 | 58,684,497 | 59,271,342 | 290,546,075 |

Sales Tax Collections | 48,268,781 | 49,475,500 | 50,712,388 | 51,980,198 | 53,279,703 | 253,716,570 |

Other Financing Sources 22,400,000 - - - - 22,400,000

Interest 6,197,949 1,310,000 1,210,000 1,210,000 1,210,000 11,137,949

PECO - Charter Schools 4,457,781 - - - - 4,457,781

CO & DS Distribution per DOE Estimate 2,467,310 2,467,310 2,467,310 2,467,310 2,467,310 12,336,550

![]()

$ 132,175,950 $

60,527,794 $

46,131,105 $ 429,827,822

EXPENDITURES | ||

Construction | $ 82,464,000 | $ 108,528,973 |

Angeline 6-12 School - New Construction | 4,528,000 | - |

CO & DS Interest/Undistributed per DOE Estimate 48,947 48,947 48,947 48,947 48,947 244,735

TOTAL REVENUES $ 219,808,601 $ 193,789,638 $ 199,649,793 $ 205,854,022 $ 212,313,526 $ 1,031,415,580

- | - - 4,528,000 | ||||

Chester W. Taylor ES - Facility Expansion - - 6,320,000 | 22,336,000 | - | 28,656,000 | ||

Cypress ES - Facility Expansion 2,500,000 2,665,000 22,640,000 | 6,378,152 | - | 34,183,152 | ||

Dayspring Academy - New Construction Charter 5,094,000 - - | - | - | 5,094,000 | ||

District Wide - Site Improvements (Improve pick-up/drop-off) Share cost with county | - 600,050 | 633,400 | 666,750 | 700,100 | 2,600,300 |

Fox Hollow ES - Facility Expansion | - - | - | - | 27,222,000 | 27,222,000 |

Gulf MS - Facility Expansion/Addition | - | - | 70,490,000 - - 70,490,000 | ||

Hudson HS - Athletic Facilities Renovation | - | - | - 6,866,492 - 6,866,492 | ||

Hudson HS - School Renovations | 600,000 | - | - - - 600,000 | ||

Hudson HS - Concession Stand Bathrooms - Baseball/Softball | - | 354,075 | - - - 354,075 | ||

J.W. Mitchell HS - Facility Expansion | - | - | - 6,650,000 - 6,650,000 | ||

K-8 School - New Construction (Smith 54) | 34,742,000 | 36,656,000 | - - - 71,398,000 | ||

Land O' Lakes HS - Athletic Facility Renovation | - - | 12,703,757 | - - | 12,703,757 | ||

Land O' Lakes HS - Concession Stand Bathrooms - Baseball/Softball | - - | 370,750 | - - | 370,750 | ||

Marchman TC - Facility Expansion 10,000,000 7,248,800 - | - - | 17,248,800 | ||||

Pasco HS - Athletic Facilities Renovation - - 14,335,243 | - - | 14,335,243 | ||||

Pasco HS - Facility Expansion 6,000,000 25,690,600 1,132,000 | - - | 32,822,600 | ||||

Thomas E. Weightman MS - Facility Expansion - - - 9,254,400 - | 9,254,400 | |||||

Wesley Chapel HS - Athletic Facilities Renovation - - - - 2,127,005 | 2,127,005 | |||||

Wesley Chapel HS - Facility Expansion/Addition - - - 8,376,000 - | 8,376,000 | |||||

West Zephyrhills ES - Facility Expansion 19,000,000 35,314,448 3,550,800 - - | 57,865,248 | |||||

Wiregrass Ranch HS - Facility Expansion - - - - 16,082,000 | 16,082,000 | |||||

Maintenance | $ 23,164,649 | $ 35,730,864 | $ 28,881,916 | $ 16,241,560 | $ 15,618,423 | $ 119,637,412 |

Annual Accordion Door Renovation | 226,680 | 240,020 | 253,360 | 266,700 | 280,040 | 1,266,800 |

Annual Athletic Bleacher Repair | 175,000 | 186,673 | 198,345 | 210,018 | 221,690 | 991,726 |

Annual Athletic Fields & Courts | 275,000 | 293,343 | 311,685 | 330,028 | 348,370 | 1,558,426 |

R.B. Stewart MS - Resurface Basketball Courts | - | 47,742 | - - - | 47,742 | ||

River Ridge HS - Resurface Tennis/Basketball Courts | 312,406 | - | - - - | 312,406 | ||

Annual Athletic Sound & Scoreboards | 90,000 | 96,003 | 102,006 | 108,009 | 114,012 | 510,030 |

Annual Capital Projects Improvements | 1,518,400 | 1,619,677 | 1,720,955 | 1,822,232 | 1,923,509 | 8,604,773 |

Annual Compliance with ADA | 113,340 | 120,010 | 126,680 | 133,350 | 140,020 | 633,400 |

Annual Compliance w/Environmental Reg | 235,000 | 250,675 | 266,349 | 282,024 | 297,698 | 1,331,746 |

Annual Elevator Upgrade | 226,680 | 240,020 | 253,360 | 266,700 | 280,040 | 1,266,800 |

Annual Energy Retrofits | 120,000 | 128,004 | 136,008 | 144,012 | 152,016 | 680,040 |

Annual Enhanced Hurricane Protection Area Compliance | 13,496 | 14,163 | 14,830 | 15,497 | 16,164 | 74,150 |

Annual Exterior Building Renovations (Paint) | 475,000 | 506,683 | 538,365 | 570,048 | 601,730 | 2,691,826 |

Annual Fencing | 90,000 | 96,003 | 102,006 | 108,009 | 114,012 | 510,030 |

Annual Fire Alarm Systems | 226,680 | 240,020 | 253,360 | 266,700 | 280,040 | 1,266,800 |

Annual Fire Safety | 202,440 | 212,445 | 222,450 | 232,455 | 242,460 | 1,112,250 |

Annual FNS Serving Line Renovations | 226,680 | 240,020 | 253,360 | 266,700 | 280,040 | 1,266,800 |

Annual Flooring Renovations | 374,022 | 396,033 | 418,044 | 440,055 | 462,066 | 2,090,220 |

Annual Generator Repairs/Replacement | 67,480 | 70,815 | 74,150 | 77,485 | 80,820 | 370,750 |

Annual Gym Floors Maintenance and Replacement | 235,000 | 250,675 | 266,349 | 282,024 | 297,698 | 1,331,746 |

River Ridge HS - Replace Gym Floor | 453,360 | - | - | - | - | 453,360 |

Seven Springs MS - Replace Gym Floor | - | - | 253,360 | - | - | 253,360 |

Annual Health-Safety-Life | 269,920 | 283,260 | 296,600 | 309,940 | 323,280 | 1,483,000 |

Annual HVAC Renovations and Replacements | 344,525 | 362,625 | 380,725 | 398,825 | 416,925 | 1,903,625 |

Bayonet MS - Replace Gym A/C units | - | 152,150 | - | - | - | 152,150 |

Gulf MS - Replace Campus & Gym Chillers. 160T & 120T | 686,880 | - | - | - | - | 686,880 |

Lacoochee ES - New 10T Split System for Admin Bldg | - | - | - | - | 170,250 | 170,250 |

Longleaf ES - Replace 2 Carrier Chillers - 125T | 629,640 | - | - | - | - | 629,640 |

Oakstead ES - Replace Chillers (2) - 120T | - | - | 709,280 | - | - | 709,280 |

Pasco HS - Two New Air Handlers Above the Gym | 536,200 | - | - | - | - | 536,200 |

Pine View ES - Replace 2 Chillers - 125T | 636,720 | - | - | - | - | 636,720 |

Rodney B. Cox ES - Change All Thermostats | - | - | - | 58,032 | - | 58,032 |

San Antonio ES - New Chiller | 629,120 | - | - | - | - | 629,120 |

Sunray ES - Replace 2 Chillers - 125T | - | 669,460 | - | - | - | 669,460 |

Thomas E. Weightman MS - Two New Cooling Towers | - | - | - | 322,400 | - | 322,400 |

Trinity ES - Replace 2 Chillers - 125T | - | - | 709,280 | - | - | 709,280 |

Trinity Oaks ES - Two New Chillers Needed | 550,000 | - | - | - | - | 550,000 |

Wiregrass Ranch HS - Two New Chillers Needed - | - | 1,704,080 | - - 1,704,080 | |||

Zephyrhills HS - Two New Chillers Needed - | 457,920 | - | - | - | 457,920 | |

Annual HVAC Systems - Controls - | 322,400 | 340,500 | 358,600 | 376,700 | 1,398,200 | |

Calusa ES - Upgrade HVAC Controls | - | - | 322,400 | - | - | 322,400 |

Connerton ES - Upgrade HVAC Controls | - | 304,300 | - | - | - | 304,300 |

Longleaf ES - Upgrade HVAC Controls | - | 243,440 | - | - | - | 243,440 |

New River ES - Upgrade HVAC Controls | - | - | 322,400 | - | - | 322,400 |

Oakstead ES - Upgrade HVAC Controls | - | - | - | 272,400 | - | 272,400 |

Pasco ES - New A/C Controls In The Cafeteria | - | 228,960 | - | - | - | 228,960 |

Pasco HS - Need Controls | - | - | 426,020 | - | - | 426,020 |

Paul R. Smith MS - Upgrade HVAC Controls, NAE 1 & 2 | 343,440 | - | - | - | - | 343,440 |

R.B. Stewart MS - Upgrade HVAC Controls | - | - | - | - | 358,600 | 358,600 |

Veterans ES - Upgrade HVAC Controls | 286,200 | - | - | - | - | 286,200 |

Wendell Krinn Tech HS - Upgrade HVAC Controls | - | - | - | 340,500 | - | 340,500 |

Annual Kitchen Epoxy | 235,000 | 250,675 | 266,349 | 282,024 | 297,698 | 1,331,746 |

Annual Lift Station Upgrades | 120,000 | 128,004 | 136,008 | 144,012 | 152,016 | 680,040 |

Annual Pavement Maintenance | 476,028 | 504,042 | 532,056 | 560,070 | 588,084 | 2,660,280 |

Centennial MS - Mill and Repave All Parking Lots/Roads | - | 239,557 | - | - | - | 239,557 |

Maintenance Dept - Mill and Repave All Parking Lots/Roads | - | 612,644 | - | - | - | 612,644 |

Moon Lake ES - Mill and Repave All Parking Lots/Roads | - | 120,010 | - | - | - | 120,010 |

Planning/Security - Mill and Repave Parking Lot | - | 19,719 | - | - | - | 19,719 |

Transportation Central - Mill and Repave All Parking Lots/Roads | - | 322,156 | - | - | - | 322,156 |

Transportation East - Mill and Repave All Parking Lots/Roads | - | 159,272 | - | - | - | 159,272 |

River Ridge HS - Roof Replacement - 5,881,579 - - | - | 5,881,579 | ||||

Seven Oaks ES - Gutter Replacement 182,678 - | - - | - | 182,678 | |||

Seven Springs MS - Roof Maintenance 5,840,291 - | - - | - | 5,840,291 | |||

Transportation W - Roof Replacement - - | - 861,169 | - | 861,169 | |||

Trinity Oaks ES - Gutter Replacement - 184,383 | - - | - | 184,383 | |||

Wesley Chapel HS - Roof Replacement Annual School Security & Hardening | - - | 7,425,273 950,100 | - 1,000,125 | - 1,050,150 | - 1,100,175 | 7,425,273 4,100,550 |

Annual Security System Installs & Repairs | - | 24,002 | 25,336 | 26,670 | 28,004 | 104,012 |

Annual Signs-Marquee | 26,992 | 28,326 | 29,660 | 30,994 | 32,328 | 148,300 |

Annual Storage Buildings | 73,671 | 78,007 | 82,342 | 86,678 | 91,013 | 411,711 |

Bayonet Point MS - Remodel Gym Restrooms & Entry Way Tile | - | - | 253,360 | - | - | 253,360 |

CFA @ RRHS - Paint, Replace Theater Seats, Carpert, Sound Board | 900,000 | - | - | - | - | 900,000 |

CFA @ WCHS - Replace Theater Seats and Sound Board | - | 632,000 | - | - | - | 632,000 |

Denham Oaks ES - Accordion Door Replacement | - | 120,010 | - | - | - | 120,010 |

Gulf HS - Remodel Gym Restrooms & Entry Way Tile | - | 272,220 | - | - | - | 272,220 |

Hudson ES (WPEA) - Remodel Restrooms ADA Study | 34,002 | - | - | - | - | 34,002 |

Hudson ES (WPEA) - Remodel Restrooms ADA | - | 908,164 | - | - | - | 908,164 |

Eastside Maintenance Facility | - | 1,011,200 | - - - | 1,011,200 | ||

Rodney B. Cox ES - Covered Play Area - includiing OTIS WI-FI | - | 448,014 | - - - | 448,014 | ||

Sand Pine ES - Retile 33 Restrooms | - | 140,952 | - - - | 140,952 | ||

Wendell Krinn Tech HS - Remodel Front Office | - | 101,344 | - - - | 101,344 | ||

Vehicles & Equipment | $ 7,801,107 | $ 15,521,962 | $ 16,454,414 | $ 17,386,869 | $ 18,436,481 | $ 75,600,833 |

Annual Athletic Equipment - 84010 | 156,435 | 162,870 | 169,305 | 175,740 | 182,175 | 846,525 |

Annual Automated External Defibrillators (AED) | 45,336 | 48,004 | 50,672 | 53,340 | 56,008 | 253,360 |

Annual Bi-Directional Amplifiers Equipment | - | 633,400 | 666,750 | 700,100 | 733,450 | 2,733,700 |

Annual CTE Equipment | 100,000 | 156,435 | 162,870 | 169,305 | 175,740 | 764,350 |

Annual Custodial & Maintenance Equipment Replacement | 650,000 | 677,885 | 705,770 | 733,655 | 761,540 | 3,528,850 |

Annual Data Center Server Refresh | 300,000 | 300,000 | 300,000 | 300,000 | 300,000 | 1,500,000 |

Annual ESE Equipment | 80,000 | 104,290 | 108,580 | 112,870 | 117,160 | 522,900 |

Annual ESE Seat Belt Equipment | 12,265 | 12,694 | 13,123 | 13,552 | 13,981 | 65,615 |

Annual Furniture & Equipment Special Request | 1,000,000 | 782,175 | 814,350 | 846,525 | 878,700 | 4,321,750 |

Annual Furniture Portable & Growth | 108,580 | 112,870 | 117,160 | 121,450 | 125,740 | 585,800 |

Annual Music/Fine Arts Capital Equipment | 175,000 | 156,435 | 162,870 | 169,305 | 175,740 | 839,350 |

Annual Motor Vehicles (White Fleet) | 783,150 | 842,500 | 901,850 | 961,200 | 1,020,550 | 4,509,250 |

Annual Network Services Tools | 5,000 | 5,215 | 5,429 | 5,644 | 5,858 | 27,146 |

Annual School Buses | 3,640,000 | 4,072,068 | 4,504,136 | 4,936,204 | 5,368,272 | 22,520,680 |

Annual School Safety & Security Equipment | - | 1,900,200 | 2,000,250 | 2,100,300 | 2,200,350 | 8,201,100 |

Annual School Furniture Refresh | - | 4,514,800 | 4,686,400 | 4,858,000 | 5,029,600 | 19,088,800 |

Annual School Furniture Replacement | 500,000 | 782,175 | 814,350 | 846,525 | 878,700 | 3,821,750 |

Annual Technology Equipment Replacement | 50,000 | 52,145 | 54,290 | 56,435 | 58,580 | 271,450 |

Annual Time Clock Replacement | 55,000 | 57,360 | 59,719 | 62,079 | 64,438 | 298,596 |

Annual Transportation Tools & Equipment | 10,000 | 10,429 | 10,858 | 11,287 | 11,716 | 54,290 |

Annual Weight Room Equipment Upgrades | 130,341 | 138,012 | 145,682 | 153,353 | 161,023 | 728,411 |

UPS Data Center Battery Replacement (Every 5 years) | - | - | - | - | 117,160 | 117,160 |

Technology | $ 5,719,875 | $ 12,012,390 | $ 12,611,425 | $ 15,110,460 | $ 15,409,495 | $ 60,863,645 |

Annual Classroom Display Installation | 919,875 | 952,050 | 984,225 | 1,016,400 | 1,048,575 | 4,921,125 |

Annual Computer Devices - Student Growth | - | 2,640,220 | 2,786,960 | 2,933,700 | 3,080,440 | 11,441,320 |

Annual Computer Refresh Cycles | 2,000,000 | 5,500,000 | 5,800,000 | 8,000,000 | 8,000,000 | 29,300,000 |

Annual District Wide Software | 2,800,000 | 2,920,120 | 3,040,240 | 3,160,360 | 3,280,480 | 15,201,200 |

Other | $ 4,334,784 | $ 36,919,444 | $ 14,663,318 | $ 15,409,573 | $ 4,614,309 | $ 75,941,428 |

Annual Athletic Storage Sheds | 26,068 | 27,602 | 29,136 | 30,671 | 32,205 | 145,682 |

Annual Habitat for Humanities | 67,480 | 70,815 | 74,150 | 77,485 | 80,820 | 370,750 |

Annual Network IP Phone Infrastructure | 600,000 | 600,000 | - | - | - | 1,200,000 |

Annual Network Services Infrastructure Upgrades | - | 9,965,493 | 10,490,200 | 11,014,907 | - | 31,470,600 |

Annual Network Services Renovation Projects | 1,619,520 | 1,699,560 | 1,779,600 | 1,859,640 | 1,939,680 | 8,898,000 |

Annual Renovation and Remodeling (Emergency Reserves) | 2,000,000 | 2,133,400 | 2,266,800 | 2,400,200 | 2,533,600 | 11,334,000 |

Annual Signs - FISH | 21,716 | 22,574 | 23,432 | 26,670 | 28,004 | 122,396 |

Other Financing Uses | - | 22,400,000 | - | - | - | 22,400,000 |

Debt Service | $ 93,904,446 | $ 88,522,511 | $ 65,987,747 | $ 65,326,539 | $ 67,119,703 | $ 380,860,946 |

Transfers Out - COPS Bond Payment | 47,387,022 | 47,402,432 | 47,409,723 | 47,239,532 | 48,687,275 | 238,125,984 |

Transportation Northwest - Mill and Repave All Parking Lots/Roads | - | 198,440 | - - - | 198,440 | ||

Transportation Southeast - Mill and Repave All Parking Lots/Roads | - | 293,362 | - - - | 293,362 | ||

Annual Playground Structures | 1,000,000 | 1,066,700 | 1,133,400 | 1,200,100 | 1,266,800 | 5,667,000 |

Annual Portables Moves | 300,025 | 316,700 | 333,375 | 350,050 | 366,725 | 1,666,875 |

Annual New Portables - Growth | 3,000,000 | 3,128,700 | 3,257,400 | 3,386,100 | 3,514,800 | 16,287,000 |

Annual Roof Replacement | - | 337,200 | 359,000 | 380,800 | 402,600 | 1,479,600 |

Administration Warehouse - Roof Replacement | - | - | 2,218,776 | - | - | 2,218,776 |

Chasco ES - Roof Maintenance | - | 63,442 | - - - | 63,442 | ||

Chasco MS - Roof Maintenance | - | 126,884 | - - - | 126,884 | ||

Gulf MS - Gutter Replacement | - | 308,083 | - - - | 308,083 | ||

Land O' Lakes HS - Roof Replacement | - | 627,646 | - - - | 627,646 | ||

Longleaf ES - Gutter Replacement | - | 212,580 | - - - | 212,580 | ||

Mittye P. Locke ES - Roof Maintenance | - | - 3,102,645 - - 3,102,645 | ||||

Oakstead ES - Gutter Replacement | - | 215,935 - - - 215,935 | ||||

Pasco HS - Roof Maintenance | - | - 5,175,777 - - 5,175,777 | ||||

Paul R. Smith MS - Gutter Replacement | 225,602 | - - - - 225,602 | ||||

Pine View ES - Gutter Replacement | 181,051 | - - - - 181,051 | ||||

Transfers Out - Finance Payments: Computers 6,193,903 4,161,677 1,824,742 - - 12,180,322

Transfers Out - Finance Payments: Vehicles 4,210,453 3,156,995 2,416,464 1,678,761 1,006,724 12,469,397

Transfers Out - Sales Tax Bond Payment | 21,303,099 | 21,277,018 | - - - 42,580,117 | |||

Transfers Out - Charter Schools Millage | 400,808 | 974,389 | 1,736,818 2,758,246 2,725,704 8,595,965 | |||

Transfers Out - Charter Schools PECO | 4,457,781 | - | - - - 4,457,781 | |||

Transfers Out - Property Insurance | 9,951,380 | 11,550,000 | 12,600,000 | 13,650,000 | 14,700,000 | 62,451,380 |

TOTAL EXPENDITURES | $ 217,388,861 | $ 297,236,144 $ 270,774,770 $ | 190,002,795 | $ 167,329,516 | $ 1,142,732,086 | |

Net Change in Fund Balance | $ 2,419,740 | $ (103,446,506) $ (71,124,977) $ | 15,851,227 | $ 44,984,010 | $ (111,316,506) | |

FUND BALANCE - BEGINNING | 309,317,708 | 311,737,448 | 208,290,942 | 137,165,965 | 153,017,192 | 309,317,708 |

FUND BALANCE - ENDING | $ 311,737,448 | $ 208,290,942 $ 137,165,965 $ | 153,017,192 | $ 198,001,202 | $ 198,001,202 | |

BUDGET SUMMARY |

SPECIAL REVENUE FUNDS |

2023-2024 |

BUDGET |

2022-2023 |

BUDGET |

ESTIMATED REVENUE:

Federal Projects | 53,647,214 |

School Food Service | 86,568,254 |

![]()

TOTAL ESTIMATED REVENUE AND FUND BALANCE | 140,215,468 |

APPROPRIATIONS:

54,043,579

70,846,953

124,890,532

![]()

Federal Projects | 53,647,214 |

School Food Service | 86,568,254 |

54,043,579

70,846,953

TOTAL APPROPRIATIONS AND | |

FUND BALANCE | 140,215,468 |

124,890,532

![]()

![]()

BUDGET SUMMARY |

INTERNAL SERVICE FUNDS |

2023-2024 |

BUDGET |

2022-2023 |

BUDGET |

ESTIMATED REVENUE:

Local | 107,109,906 |

Interest Income | 1,052,545 |

Incoming Transfer | 9,951,380 |

Nonrevenue Sources | 158,000 |

104,941,790 |

122,284 |

5,810,001 |

158,000 |

Fund Balance | 43,820,626 |

RESERVES:

TOTAL ESTIMATED REVENUE AND | |