< Previous | Contents | Next >

Property Tax Levies and Collections Last Ten Fiscal Years

(Unaudited)

Taxes Levied

Collected within the Fiscal Year of the Levy

Collections

Total Collections to Date

![]()

![]()

Fiscal for the Percentage in Subsequent Percentage Year Fiscal Year Amount (A) of Levy Years Amount (A) of Levy

![]()

![]()

![]()

![]()

![]()

![]()

![]()

2021 | $ 207,477,905 | $ 200,200,819 | 96.5% | $ - | 200,200,819 | 96.5% |

2020 | 199,290,938 | 192,353,424 | 96.5% | 116,661 | 192,470,085 | 96.6% |

2019 | 189,162,255 | 182,682,918 | 96.6% | 87,788 | 182,770,706 | 96.6% |

2018 | 179,218,000 | 173,280,469 | 96.7% | 80,159 | 173,360,628 | 96.7% |

2017 | 171,248,625 | 165,568,248 | 96.7% | 89,749 | 165,657,997 | 96.7% |

2016 | 168,011,731 | 162,533,528 | 96.7% | 93,052 | 162,626,580 | 96.8% |

2015 | 160,986,519 | 155,605,008 | 96.7% | 159,639 | 155,764,647 | 96.8% |

2014 | 157,875,272 | 152,490,829 | 96.6% | 161,858 | 152,652,687 | 96.7% |

2013 | 156,192,206 | 151,072,442 | 96.7% | 142,954 | 151,215,396 | 96.8% |

2012 | 171,750,509 | 165,642,379 | 96.4% | 554,161 | 166,196,540 | 96.8% |

Note:

Property Taxes become due and payable on November 1st of each year. A four percent (4%) discount is allowed if the taxes are paid in November, with the discount declining by one percent (1%) each month thereafter.

Accordingly, taxes collected usually will not be 100% of the tax levy. Taxes become delinquent on April 1st of each year and tax certificates for the full amount of any unpaid taxes and assessments must be sold no later than June 1st of each year.

(A) Net of allowable discounts

![]()

Sources: District Records

Direct and Overlapping Property Tax Rates Last Ten Fiscal Years

![]()

![]()

![]()

(per $1,000 assessed valuation) (Unaudited)

Fiscal Year | Local Required Effort Millage (2)

| Discretionary Local Millage

| Supplemental Discretionary Millage (1)

| Capital Improvement Millage

| Total Pasco Schools | Pasco County |

2021 | 3.674 | 0.748 | 0.000 | 1.500 | 5.922 | 7.608 |

2020 | 3.853 | 0.748 | 0.000 | 1.500 | 6.101 | 7.608 |

2019 | 4.031 | 0.748 | 0.000 | 1.500 | 6.279 | 7.608 |

2018 | 4.317 | 0.748 | 0.000 | 1.500 | 6.565 | 7.608 |

2017 | 4.529 | 0.748 | 0.000 | 1.500 | 6.777 | 7.608 |

2016 | 4.861 | 0.748 | 0.000 | 1.500 | 7.109 | 7.608 |

2015 | 4.901 | 0.748 | 0.000 | 1.500 | 7.149 | 7.344 |

2014 | 5.109 | 0.748 | 0.000 | 1.500 | 7.357 | 7.344 |

2013 | 5.093 | 0.748 | 0.000 | 1.500 | 7.341 | 6.862 |

2012 | 5.396 | 0.748 | 0.000 | 1.500 | 7.644 | 6.367 |

(1) For the 2009-2010 fiscal year and thereafter, the State of Florida combined the Supplemental Discretionary and Discretionary Local Millage i one Millage rate.

![]()

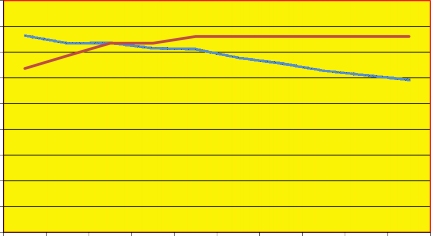

Property Tax Rates by Government

9.0

8.0

7.0

6.0

5.0

4.0

3.0

2.0

1.0

0.0

2012 2013 2014 2015 2016 2017 2018 2019 2020 2021

Pasco Schools Pasco County

![]()

![]()

Source: Pasco County website - www.pascocountyfl.net

Principal Property Taxpayers Current and Nine Years Ago (Unaudited)

![]()

2021 2012

![]()

![]()

Taxpayer Rank | Taxable Assessed Valuation

| Percentage of Total Assessed Value

| Rank | Taxable Assessed Valuation | Percentage of Total Assessed Value | |

Duke Energy Center | 1 | $ 470,479,198 | 1.20% | |||

Withlacoochee River Electric Cooperative | 2 | 297,389,980 | 0.76% | 3 | 210,830,519 | 0.80% |

HCA Health services of Florida | 3 | 135,547,167 | 0.35% | 9 | 76,511,724 | 0.29% |

Frontier Florida LLC (1) | 4 | 119,017,248 | 0.30% | 2 | 202,049,259 | 0.76% |

Tampa Premium Outlets LLC | 5 | 90,257,546 | 0.23% | |||

Pasco Ranch Inc | 6 | 87,254,988 | 0.24% | |||

Florida Gas Transmission Co | 7 | 81,461,829 | 0.21% | |||

Bright House Networks LLC | 8 | 81,267,183 | 0.21% | 6 | 93,827,343 | 0.35% |

Tampa Electric Co | 9 | 79,104,670 | 0.20% | |||

Publix Super Markets Inc | 10 | 72,857,861 | 0.19% | 10 | 46,953,134 | 0.17% |

Florida Power Corp. | 1 | 349,801,684 | 1.33% | |||

Shady Hills Power Company LLC | 4 | 117,387,065 | 0.44% | |||

Goodforest LLC | 5 | 100,620,462 | 0.38% | |||

Wal-Mart Stores | 7 | 82,413,729 | 0.31% | |||

Zephyrhills Bottle Water America, Inc. | 8 | 67,413,905 | 0.25% | |||

Total | $ 1,514,637,670 3.89% | $ 1,347,808,824 5.08% | ||||

(1) Formerly Verizon Communications Inc.

![]()

Source: Pasco County Property Appraiser

District School Board of Pasco County 2012 CAFR