Why Budget? Information by Federal Reserve Bank of Atlanta

Pasco County Schools with our valued community partners invite you to join us throughout April for our Financial Literacy Month Experience.

Check Students/Community/Teachers Tabs below for various informative resources.

New resources will be updated throughout the month.

Financial Literacy Month Experience

Resources through Xello Platform

Students can navigate to the grade level specific topics in Xello.

Click Here to learn more about Truist

Suncoast Credit Union Resources

Saving For College : Resources by Econlowdown

Suncoast offers savings solutions with features and benefits that will set you on the right track, right from the start. We also have resources like a college savings calculator to help make a savings plan that works for you.

LEARN ABOUT STUDENT SAVINGS ACCOUNTS

Financial Games by Suncoast Credit Union

Balance Track Suncoast CU (balancepro.org)

FPA College Financial Survival Guide Presentation

Annuity.org Financial Literacy Resources

Pheabs Finance Scholarship Award

Pheabs mission is to help raise financial awareness so that everyone makes responsible fiscal decisions. Pheabs Financial Awareness Scholarship seeks to champion students who share the same values. Our $2000 award offers 3 students the chance to win a contribution towards their education with the 1st place winner receiving $1000, and both 2nd and 3rd place receiving $500.

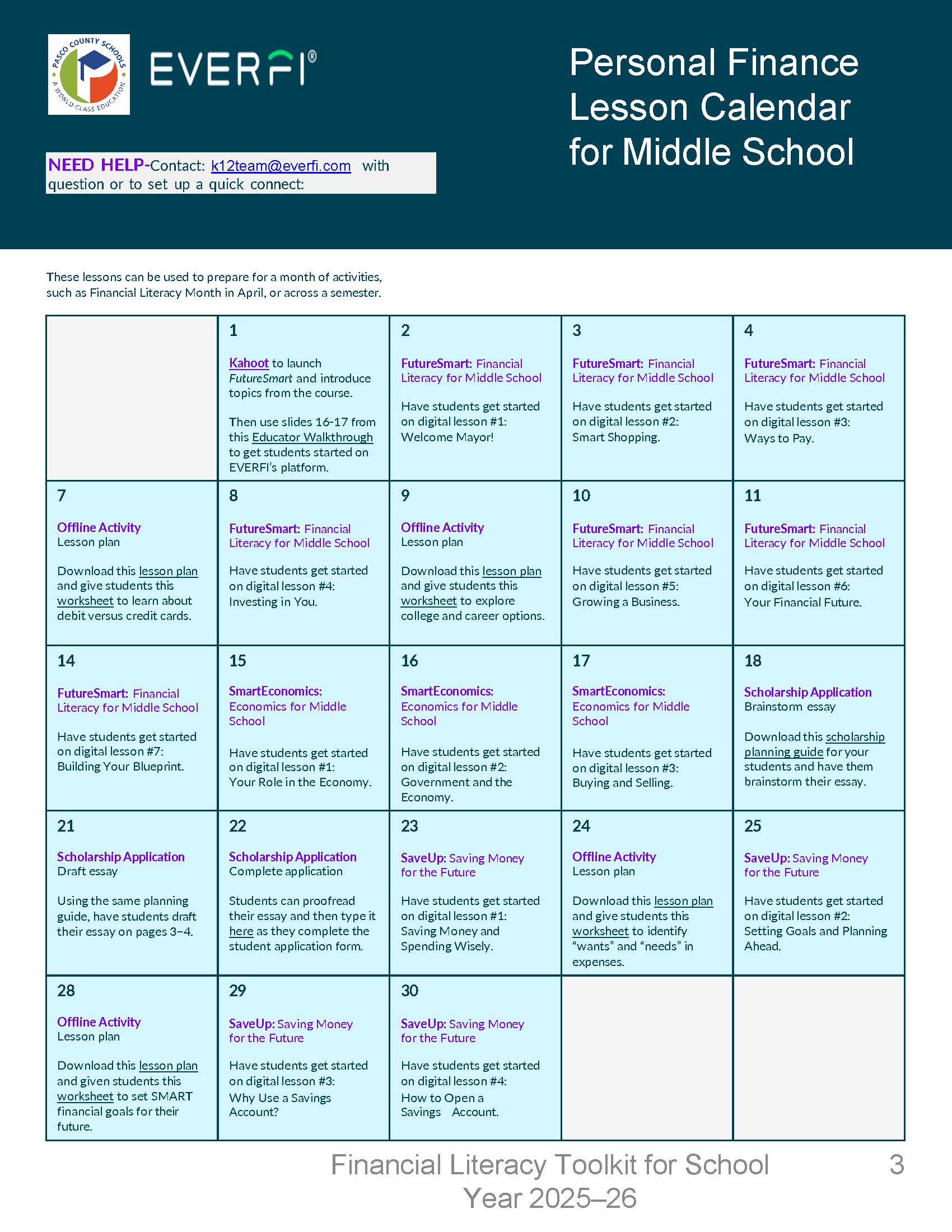

The Truist Spring Scholarship is still accepting entries!

Did you know that your students are eligible to enter the Truist Financial Foundations Scholarship Contest once they complete three digital lessons of EVERFI: Financial Literacy? Follow the steps below to make sure your students qualify and apply before April 30th.

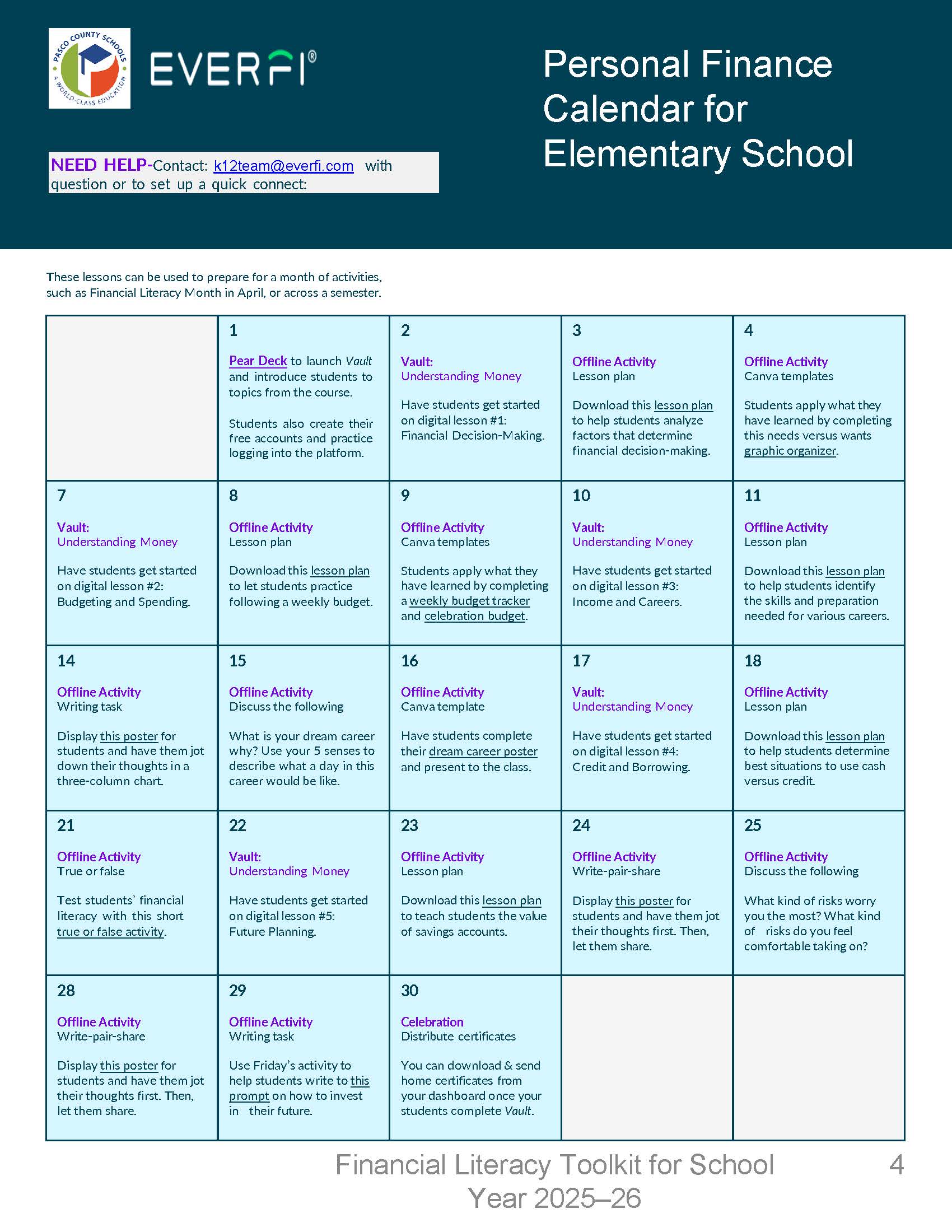

FutureSmart Scholarship Contest- Middle School

As a FutureSmart student, you’re eligible to enter the scholarship contest for an opportunity to be awarded a gift card to a 529 college savings plan. Throughout the school year, a total of twenty students will receive a $2,000 gift card and two grand prize winners will receive a $5,000 gift card. Information may be found here.

Financial Games by Suncoast Credit Union

Financial Literacy Month’s mission has always been to promote, advocate for and support financial literacy efforts across the U.S.

The average American household has $145,000 of debt

Discovery Education Teacher Newsletter

Tax Simulation & Workshop

EVERFI and Intuit TurboTax invites you for a virtual workshop and tax simulation on multiple dates throughout April and May. See details and registration below.

♦️ Who: 8-12th grade students

♦️ When: April-May

♦️ Where: Virtually from their classroom

♦️ What: During a 45-minute session, students will engage in activities to prepare for Tax Day now and in the future. We'll then set them up to work independently through an interactive primer on employment and taxes, followed by a tax simulation.

♦️ How: Teachers can register once on behalf of their class and project the workshop on the board. Click here to register.

Click, Learn, and Teach

Educators can enroll in any of a series of online professional development programs available from the Federal Reserve Banks of Atlanta and St. Louis. With three different options to consider, you can select according to your preferred time commitment and level of educational attainment: graduate credit, continuing education credit, or FRB certification.

Student Learning

Suncoast offers a wealth of resources for kids, teens and young adults to help give them a head start to make wise financial decisions early in life. Our learning resources include in-school programs and hands-on exercises and workshops, all specially designed for students.

VIEW OUR FINANCIAL LITERACY WORKSHOPS

LEARN ABOUT OUR IN-SCHOOL PROGRAMS

LEARN ABOUT OUR STUDENT CAREER DEVELOPMENT

High School Resources

-

Read about 11 Money Skills Teens Need Before Graduation to help prepare students for life after graduation.

-

Use this tax simulation facilitator guide and teacher discussion guide to teach your high school students how to complete their taxes in advance of the 4/15 tax deadline.

Middle School Resources

-

Learn how to teach middle school students financial literacy in a way that stays with them.

-

Check out this facilitator guide to walk you through each step of the process to using FutureSmart in the classroom.

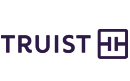

Elementary School Resources

-

Read why teaching money skills should be part of every math class.

-

Use this Pear Deck to engage students on Vault: Financial Literacy for Kids.

|

|

|

|

Suncoast Credit Union

Pasco Young Entrepreneurs

Ameriprise Financial

EverFi

Click here to access instructions to apply for the EVERFI Scholarship opportunities for Pasco County Students

Mid Florida

Embark on a journey towards financial literacy with MIDFLORIDA Money Minute, a cutting-edge online platform free to the public, and meticulously crafted to enhance your comprehension of personal finance. This all-encompassing website boasts an array of invaluable resources, designed to provide you and your students with comprehensive financial education:

Financial Literacy Information.pdf

- Comprehensive Courses: Courses span a broad spectrum of financial subjects, tailored to accommodate individuals at every level of expertise.

- Educational Videos: Engaging and informative videos that untangle complex financial concepts, providing an enjoyable learning experience.

- Financial Calculators: Confidently navigate financial decisions using our practical calculators, offering insights into budgeting, saving, debt reduction, investing and more.

- College/Career Explorers: Strategically plan your future with our college and career exploration tools, enabling well-informed decisions about your educational and professional journey.

- Product Links: Gain access to essential financial products through our curated links, empowering you to make informed choices that align seamlessly with your goals.

Explore MIDFLORIDA Money Minute, and elevate your financial understanding today!

Fifth Third Bank

Financial Wellness Workshop Course Overview

Fifth Third Bank Financial Academy

Fifth Third is awarding twenty-nine students across the country with a $2,500 529 College Savings Card. Did you know that your students are eligible to enter the contest once they complete one lesson from Finance Academy?